If you want to learn how to analyze altcoin fundamentals, then this piece is just for you.

Ever feel like every week there’s a shiny new altcoin promising to change the world? Yeah, we’ve all been there. Eyes wide, hearts hopeful, wallets slightly nervous. In the fast-moving world of crypto, it’s easy to get swept up in hype. But here’s the thing: not every project is worth your attention (or your money).

That’s where knowing how to analyze altcoin fundamentals can make all the difference. It’s the difference between throwing darts in the dark and making smart, informed choices. Because behind every flashy logo and clever name lies a story. And your job is to figure out if it’s solid or just smoke and mirrors.

So, before you dive into your next altcoin adventure, let’s slow down, zoom in, and really learn what makes a project tick. The truth is in the details. Let’s find it.

Why Analyzing Altcoin Fundamentals Matters

Altcoin Stock photos by Vecteezy

Let’s be honest. Crypto space can feel like the Wild West. New coins pop up overnight, influencers shout “To the moon!” and Telegram groups light up with price predictions that sound too good to be true. Sometimes, they are.

That’s why learning how to analyze altcoin fundamentals isn’t just helpful. It’s essential.

Are You Investing… or Just Gambling?

Understanding how to analyze altcoin fundamentals isn’t just a skill—it’s your edge in a sea of market noise.

It might take time, and yes, it can feel overwhelming. But every whitepaper you study, every GitHub repo you explore, every tokenomics breakdown you grasp—it all adds up. You don’t have to be a blockchain genius. What you need is curiosity. Ask smarter questions. Dig deeper than surface-level hype.

Crypto Market Analysis Today is filled with speculation and short-term trends, but if you focus on real fundamentals, you’re setting yourself apart. While others chase the next pump, you’re building clarity, confidence, and long-term value—not just a portfolio.

So trust the process. Stay sharp. And remember: solid fundamentals will always outlast the noise.

Dodge the Rug Pulls and FOMO Traps

Ever heard of a rug pull? It’s when developers suddenly abandon a project and run off with investor funds. Poof. Gone. Sadly, it happens more than you’d think.

Then there’s FOMO (fear of missing out). It’s that gut feeling that if you don’t buy now, you’ll miss the next big thing. The problem? Most FOMO-driven choices lead to disappointment (and losses).

When you take the time to break down a project’s fundamentals, you give yourself an edge. You’ll spot the red flags before they cost you. And you’ll learn to ignore the noise when everyone’s shouting “Buy now!”

Short-Term Hype vs. Long-Term Value

Altcoins often spike hard and fast. But what goes up quickly… often crashes just as fast. That’s the nature of hype.

Real value, on the other hand, grows over time. It’s built on strong technology, a useful product, a growing user base, and a clear purpose. Fundamentals help you spot which projects are here for the long haul. And which ones are just chasing a trend.

When you think long-term, your strategy changes. You don’t panic during a dip. You know what you’re holding and why you’re holding it. That’s powerful.

The Three Ts: Trust, Transparency, and Tech

At the core of every great altcoin project are three things: trust, transparency, and solid tech.

- Trust means the team is real, experienced, and committed.

- Transparency means you can see where the tokens are going, what the roadmap looks like, and how decisions are made.

- Tech means the actual product works. And solves a real problem.

If any of these are missing, that’s a red flag. But when all three align? That’s where opportunity lives.

In a space filled with noise, trends, and traps, taking the time to understand the basics makes you a sharper, wiser investor. Remember, hype fades. Yet, fundamentals stick around. So, let’s dig deeper and uncover how to analyze altcoin fundamentals like a pro.

What Are Altcoin Fundamentals?

Let’s clear something up right away. Crypto isn’t just about watching candlestick charts dance up and down. That’s technical analysis. It’s exciting, sure. But if you’re only chasing patterns, you’re missing half the picture.

To really understand how to analyze altcoin fundamentals, you’ve got to go deeper. You’re not just watching prices. You’re studying value.

Crypto vs. Traditional Markets: What’s Different?

In traditional finance, fundamentals might mean earnings, profit margins, or market share. But altcoins don’t sell products in a conventional way. They don’t have quarterly reports or boardroom meetings.

Instead, crypto projects rely on entirely different signals. Things like how useful the token is, who’s building it, and whether it’s solving a real-world problem. So, while the word “fundamentals” is borrowed from Wall Street, the way we use it in crypto is refreshingly unique.

Technical Analysis vs. Fundamental Analysis

Think of it like this:

- Technical analysis is short-term. It’s about timing. It asks, “When should I enter or exit?”

- Fundamental analysis is long-term. It’s about understanding. It asks, “Is this worth holding at all?”

Both have their place. But if you don’t know what a coin actually does, then following chart lines is like building a house on sand.

The Core Building Blocks of Fundamentals

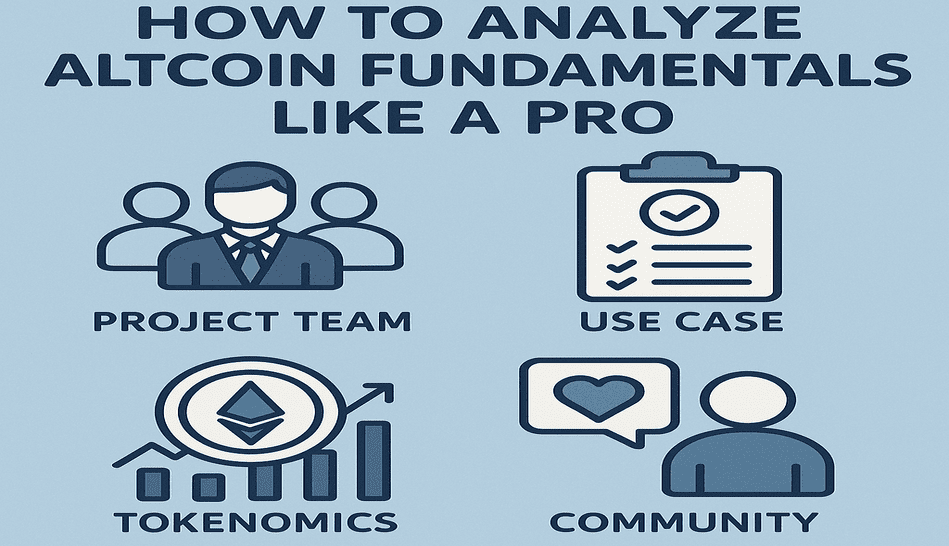

So, what are the key ingredients that make up altcoin fundamentals? Glad you asked.

- Tokenomics: How are tokens distributed? Is there a capped supply? Are the incentives fair? This can make or break a project.

- Utility: What’s the coin actually used for? If it’s just there to exist, that’s not enough. A good altcoin should power something. A platform, a service, a system.

- Community: Crypto is social. If no one’s using or talking about the coin, it might as well be invisible. A strong, active, and engaged community speaks volumes.

- Governance: Who makes the decisions? Is it a centralized team pulling strings, or do users get a say through voting or DAOs?

- Development: Is the team actually building? Frequent code updates and GitHub activity show that the project is alive and moving.

When you focus on these core elements, you’re no longer guessing. You’re investing with intention. And that’s the heart of learning how to analyze altcoin fundamentals the smart way. Let’s explore these one by one.

Tokenomics: Understanding the Economic Engine

Photo by Markus Winkler

If an altcoin were a car, then tokenomics would be the engine. The part that keeps everything running, or in some cases, sputtering out before it even gets off the line. It’s one of the most critical parts of learning how to analyze altcoin fundamentals, and yet, many skip it entirely.

Don’t be that investor.

So, What Is Tokenomics Anyway?

Tokenomics (short for token + economics) is all about how a cryptocurrency works from a financial perspective. It’s the blueprint for the coin’s economy. How it’s created, distributed, used, and even destroyed.

In other words, it answers big questions like:

- How many tokens are out there?

- Who owns most of them?

- Why should anyone actually use this token?

- Can the system survive long-term?

If these answers don’t make sense — or worse, don’t exist — that’s a giant red flag.

Why Tokenomics Matters in Fundamental Analysis

A coin can have the slickest website, the loudest community, and the prettiest chart… but if its tokenomics are broken, it’s like building a castle on quicksand.

Good tokenomics build trust. They show that the team has thought about sustainability, value, and fairness. Bad tokenomics? They’re often a sign of short-term thinking or, in the worst cases, a planned cash grab.

So, let’s break it down.

1. Total Supply, Circulating Supply, and Inflation/Deflation

These three numbers tell you a lot.

- Total supply is the maximum number of tokens that can ever exist.

- Circulating supply is how many are out in the world right now.

- Inflation or deflation refers to how that number changes over time.

Too much supply flooding the market = lower prices. Scarcity can = higher value. But balance is everything. Look for thoughtful supply caps and slow, predictable issuance.

2. Token Distribution: Who’s Holding the Bag?

This one’s huge.

How are the tokens split up? Are most of them held by the team or early investors? That could be risky. Especially if they can dump large amounts without warning.

A healthy project usually spreads tokens across:

- The core team (with long lockups).

- Investors (preferably staggered unlocks).

- The community (through rewards or airdrops).

- A treasury (to fund development and growth).

If one group holds too much, or unlock schedules are too aggressive. That’s a warning sign.

3. Real Use Cases: Is This Token Actually Needed?

Some tokens exist just to exist. No real utility, no reason to hold them, nothing they actually do.

But the strong ones? They power ecosystems. They’re used for paying fees, accessing services, voting on proposals, staking for rewards. Real stuff. That’s what creates demand.

No use case = no long-term value. Simple as that.

4. Incentives, Staking, and Rewards

Good tokenomics keep people engaged. One way they do that? Incentives.

- Staking rewards users for locking up tokens.

- Yield farming can encourage liquidity.

- Governance tokens give users voting rights.

But watch out. If rewards are too high, it may be a temporary trick to attract users, not a sustainable strategy.

5. Tokenomics Red Flags to Watch For

And now, the danger zone. Here are a few red flags that should make you pause:

- Massive token unlocks in the near future.

- Poorly explained or hidden token distribution.

- Huge pre-mine for the team or insiders.

- No clear use case or demand strategy.

- Hyperinflationary supply models.

If you see any of these, dig deeper. Sometimes it’s just bad planning. Other times, it’s a trap.

At the end of the day, solid tokenomics are what keep an altcoin alive and breathing. When you truly understand how a token flows, grows, and fits into the bigger picture, you’re not just watching.

You’re analyzing. And that’s the secret sauce behind learning how to analyze altcoin fundamentals like a pro.

The Team Behind the Project: Trust Starts with People

Image by pressfoto on Freepik

No matter how brilliant a whitepaper is (more on that later) or how shiny the roadmap looks, it all comes down to one thing: Who’s building it?

In the world of altcoins, the team can make or break a project. They’re the engine, the compass, and the glue holding the vision together. So, if you’re serious about learning how to analyze altcoin fundamentals, this is one area you just can’t skip.

People Power: Why the Team Matters

Crypto is still the Wild West. Projects rise and fall at lightning speed. And in all that chaos, one of the strongest indicators of future success is… the humans behind the scenes.

A strong, experienced, and transparent team? That’s gold.

A faceless, anonymous bunch with no track record? That’s a red flag waving in your face.

What Should You Look For?

Here’s what you need to look out for:

1. Background Checks — But Make It Web3

Start with the basics. Google the founders. Check their LinkedIn profiles. Dive into their GitHub activity if they’re developers.

- Have they built anything before?

- Do they have relevant experience in blockchain, fintech, or startups?

- Are they connected to any known and respected projects?

Real people leave digital footprints. The more public their presence, the more accountable they usually are.

2. Transparency and Visibility

A credible team doesn’t hide.

You should be able to find interviews, AMA sessions, or even casual posts on Twitter/X. The more open they are about what they’re doing — and who they are — the more confidence you can have in them.

It’s okay if a team isn’t famous. But silence? That’s suspicious.

3. Experience That Actually Matters

Now, not every crypto team needs to be full of ex-Google engineers or blockchain OGs. But you do want to see some kind of relevant expertise.

Have they launched startups before? Worked in cybersecurity, finance, or software development? Bonus points if they’ve worked together before. That means better team chemistry and less internal chaos.

4. Don’t Forget the Advisors and Partners

Look at who’s guiding and backing the project.

- Are there any notable advisors involved?

- What kind of strategic partnerships does the team highlight?

- Are these real relationships, or just name-drops with no proof?

This stuff matters. Legit partners and advisors can open doors, attract investment, and help steer the ship in the right direction.

Beware the Masked Builders

Some projects go the anonymous route. And sometimes that’s fine. Bitcoin itself started with a pseudonym, after all. But most of the time, you’ll want transparency.

If the team is totally anonymous:

- Ask why.

- Look for code activity, community engagement, and consistent updates.

- Weigh the risk vs. reward very carefully.

- Anonymity isn’t an automatic dealbreaker. But it does raise the stakes.

Trust the People, Then Trust the Project

At the end of the day, technology can be copied. Tokenomics can be tweaked. But the people behind a project? They’re unique.

That’s why, if you truly want to understand how to analyze altcoin fundamentals, don’t just look at the numbers or charts. Look at the humans.

Because behind every coin is a story. And someone is writing it.

Whitepaper & Vision: Does the Project Solve a Real Problem?

Photo by Lukas

Most people see the word whitepaper and their eyes glaze over. It sounds technical, boring, and kind of intimidating. But here’s the truth: if you want to learn how to analyze altcoin fundamentals, you have to give the whitepaper a little love.

It’s not just a document. It’s the project’s origin story, blueprint, and vision board all rolled into one.

So… What Even Is a Whitepaper?

Think of it as a pitch deck meets a master plan.

A whitepaper tells you:

- What the project is trying to solve,

- How it plans to solve it,

- And why that solution matters in the real world.

Sounds simple, right? But not all whitepapers are created equal. Some are thoughtful and full of insight. Others are just… techy word salad.

How to Read It (Without Falling Asleep)

Start by skimming. You don’t have to understand every line of code or economic model. Focus on the key parts:

- What’s the big idea?

- Why now?

- Who does this help?

- And how does the token actually fit into the puzzle?

If you can’t answer those questions by the end, the project might not be worth your time.

What Makes a Whitepaper Solid?

Here’s what makes it reliable:

1. A Real Problem to Solve

Great projects solve real-world problems. The whitepaper should lay out the issue clearly. Whether it’s inefficiency in DeFi, lack of privacy, or data ownership. If it’s vague or filled with hype, dig deeper.

2. The Tech Behind the Magic

Look for a breakdown of the technology stack. Is it built on Ethereum, Solana, or its own blockchain? How scalable or secure is it? You don’t have to be a developer. But some effort to explain the how behind the what is a good sign.

3. Token Utility & Governance

Why does this token exist? If it’s just “because crypto,” that’s a red flag. The whitepaper should explain how the token is used in the ecosystem. For access, rewards, voting, staking, etc. A strong governance model is a plus.

4. Know the Competition

Every good whitepaper talks about the competitive landscape. If it pretends to be the first of its kind when it clearly isn’t… that’s fishy. You want honesty, awareness, and a clear edge over the competition.

5. A Vision That Feels Real

Does the project have a future? Can you see it making a difference? A clear, inspiring, but achievable vision shows the team knows where they’re headed. And why.

Red Flags to Watch For

Look out for these:

- Plagiarism (Yes, it happens. Way too often.)

- Empty buzzwords like “next-gen,” “revolutionary,” or “decentralized AI blockchain metaverse” with zero explanation.

- No mention of competition. Or pretending there’s none.

- No clear roadmap or business model. Just vague dreams.

Whitepapers Don’t Need to Be Perfect… Just Honest

You don’t need to become a crypto lawyer to understand a whitepaper. You just need to ask the right questions and read between the lines.

Because at the heart of every serious project is a big “why.”

And if you’re really aiming to master how to analyze altcoin fundamentals, spotting that “why” is your first real step.

Community and Ecosystem: Is There Real Engagement?

Photo by Dio Hasbi Saniskoro

When it comes to crypto, code and tokenomics might build the machine. But community is what keeps the engine running.

That’s right. Even the smartest project with the flashiest whitepaper won’t go far without real people backing it. So if you want to master how to analyze altcoin fundamentals, you’ve got to look beyond the charts. Start listening to the noise… or the silence.

Let’s break it down.

Why Community Isn’t Just a Buzzword

A strong community does more than tweet memes or hype up token price. It:

- Spreads awareness

- Helps onboard new users

- Stress-tests the product

- Gives honest feedback

- Holds the team accountable

In short, a passionate, active community is often a sign that the project’s creating real value. Not just vaporware with a fancy logo.

Socials: Go Where the People Are

Twitter/X… This is crypto’s favorite playground. Check for:

- Regular updates from the team

- Authentic engagement in replies

- Community-driven threads, not just marketing fluff

Lots of likes and retweets? Great. But are they from real humans… or bots with anime PFPs and zero followers?

Discord & Telegram… These is where the magic (and drama) happens. Join the groups. Lurk a little. Ask a question. Is the chat alive? Are mods helpful or hiding? Is the energy chaotic, constructive, or dead silent?

These platforms offer a behind-the-scenes look at what’s really happening.

Reddit… Look for official subreddits and broader mentions across r/CryptoCurrency and r/Altcoin. Reddit often brings long-form, honest convos that hype-driven channels skip.

Dev Side: Are Builders Showing Up?

It’s not all about memes and moderators. A healthy altcoin project also needs a living, breathing developer ecosystem.

- Head to GitHub. Check the commit history.

- Are developers actively working on the codebase?

- Is there real momentum. Or has the repo been dead for months?

Even better: look for community-built tools, third-party integrations, or open dev discussions on forums like Stack Exchange.

That’s the good stuff.

Ambassadors, Hackathons, and Real Grassroots Energy

When a project empowers its fans. Not just with giveaways, but with purpose. You know it’s on the right track. Great projects often launch:

- Ambassador programs

- Hackathons

- Education campaigns

These build loyalty and excitement from the ground up. And that matters far more than paid influencers or generic ad campaigns.

Spotting Fake Hype: Don’t Get Played

Looks can deceive. Always double-check:

- Follower-to-engagement ratio on social media

- Sudden spikes in activity right before a token launch

- Telegram groups full of spammy bots or fake giveaways

If it smells fishy, it probably is.

Real Community = Real Strength

At the end of the day, analyzing the community is one of the most underrated parts of learning how to analyze altcoin fundamentals.

Because code can be copied. Roadmaps can be rewritten. But real people? Real believers? They’re hard to fake.

And when they show up — and stay — that’s when you know a project might just have the legs to go the distance.

Partnerships, Integrations & Institutional Support: Who’s Standing Behind It?

Photo by Savvas Stavrinos

In the wild west of altcoins, it’s easy to get dazzled by shiny promises and cool websites. But here’s the truth. If no one is willing to build with them, back them, or bet on them… it might just be smoke and mirrors.

When learning how to analyze altcoin fundamentals, always ask: Who’s actually supporting this project behind the scenes?

Because powerful partnerships? They often speak louder than any tweet.

Partnerships: Signals of Real-World Interest

Let’s start with the basics.

If an altcoin claims it’s going to revolutionize finance, logistics, or gaming. Check who’s co-signing that vision. Are they collaborating with:

- Known brands?

- Reputable crypto platforms?

- Web2 giants looking to go Web3?

The right partnership can supercharge adoption, improve visibility, and validate the tech. But beware of vague name-drops or “soon-to-be” alliances that never get confirmed.

Real partnerships are:

- Announced publicly

- Explained clearly

- Followed up with action

- No vague fluff — just facts.

Integrations: Are They Playing Well With Others?

In the crypto world, interoperability is key.

You want to see if the altcoin integrates with:

- Major wallets (like MetaMask or Trust Wallet)

- Exchanges (both centralized and decentralized)

- DeFi tools and dApps

- Layer-1 or Layer-2 chains

This shows that the project isn’t just living in its own bubble. It’s participating in the broader ecosystem. And that’s a green flag.

Plus, integrations often bring in new users, boost utility, and drive real demand.

Institutional Support: Who’s Putting Skin in the Game?

Now let’s talk money. And trust.

If venture capital firms, accelerators, or blockchain foundations are investing in the project, it could mean deeper due diligence has taken place. They’ve looked under the hood. And liked what they saw.

Look for names like:

But remember, just because a VC is in, doesn’t make it risk-free. It just adds another piece to the puzzle.

Real Backing Builds Confidence

In short, partnerships and integrations reveal how connected, useful, and trusted a project truly is. They’re not the only thing. But when analyzing altcoin fundamentals, they’re a piece you never want to skip.

Because crypto isn’t just about code. It’s about connection. And who believes in the mission enough to walk the path together.

Governance and Decentralization: Who’s Really in Charge?

Crypto was born from the idea of freedom. Of not having a single person or company call all the shots. That’s why, when learning how to analyze altcoin fundamentals, governance and decentralization are two things you should never ignore.

Because in crypto, who controls the project is just as important as what it promises to do.

Governance: Power to the People… or Just a Few?

Some altcoins say they’re decentralized. But dig a little, and you might find a handful of insiders making all the big decisions.

So, how can you tell who’s steering the ship?

Start by asking:

- Can token holders vote on upgrades or changes?

- Is there an active DAO (Decentralized Autonomous Organization)?

- Are the rules for voting clear, fair, and actually followed?

A transparent and fair governance model shows that a project values its community. Not just its investors.

Decentralization: Buzzword or Backbone?

Now let’s talk decentralization. A term that gets tossed around a lot. But what does it really mean?

A truly decentralized project:

- Doesn’t rely on one central server or authority

- Has a distributed network of validators or miners

- Can survive even if one part fails

Think of it like a spider web. Strong because it’s spread out, not because there’s one string holding it all together. If a project claims to be decentralized but runs everything from a single node, that’s a big red flag.

Why It All Matters

So why should you care?

Because centralized control often leads to power imbalances, shady decisions, and — sometimes — total collapses. We’ve seen it happen.

When analyzing altcoin fundamentals, good governance and true decentralization offer two key things: resilience and trust. You know the community has a voice. You know no one person can pull the rug.

And in a space as fast-moving (and chaotic) as crypto, that kind of foundation is pure gold.

In the end, look beyond the slogans. Dive into the mechanics. See who’s actually calling the shots. Because real decentralization doesn’t just sound good. It’s what makes a project truly crypto.

Market Position & Competitor Analysis: Where Does It Stand in the Crowd?

Image by studio4rt on Freepik

Crypto is crowded. Every week, a new altcoin pops up claiming to “revolutionize” something. So, how do you cut through the noise? Simple. Look at where the project stands in the bigger picture. That’s a major key when figuring out how to analyze altcoin fundamentals.

First, Who’s the Competition?

No altcoin exists in a bubble. Whether it’s solving issues in DeFi, gaming, data, privacy, or AI. Chances are, others are already in the race.

Start by asking:

- Who are its closest competitors?

- Are they already established or also just getting started?

- What makes this project different (and better)?

You’re not just investing in tech. You’re backing a business. And in business, it’s all about the edge.

What’s Its Unique Selling Point (USP)?

A project needs more than just a fancy name and shiny website. It needs a clear why.

Does it:

- Solve a real-world problem better than others?

- Offer faster, cheaper, or more secure solutions?

- Use new tech that gives it an advantage?

If the project doesn’t clearly show how it stands out, chances are… it doesn’t.

Market Fit: Is There Even a Demand?

Let’s talk demand. Because a killer idea still needs a hungry market.

Check if:

- The altcoin fits into a growing trend or sector.

- There’s actual adoption. Users, developers, real-world use.

- Big players or platforms are taking notice.

Sometimes, a smaller project might have more upside than a big-name token. If it’s solving something people care about.

Size Isn’t Everything, But…

A strong market position isn’t just about hype or market cap. It’s about knowing its lane, understanding its rivals, and having a strategy to win. So when learning how to analyze altcoin fundamentals, always zoom out. Look at the landscape. Study the map.

Because it’s not just about what the project is. It’s about where it’s going… and who it’s racing against.

On-Chain Metrics: Digging into the Blockchain Data

Photo by Markus Winkler on Unsplash

Alright, let’s get nerdy for a second.

When you’re figuring out how to analyze altcoin fundamentals, there’s gold hiding in plain sight. And it lives on-chain.

What’s On-Chain Data Anyway?

Think of the blockchain like a public diary. Every transaction, every wallet movement, every smart contract interaction. It’s all recorded. Forever. You can actually see what’s happening behind the scenes.

Forget the hype. On-chain metrics show the truth.

Metrics That Matter

So, what should you look for?

- Active Wallets – Are people really using the coin, or is it just a ghost town?

- Transaction Volume – High volume = real use. Low volume = red flag.

- Holder Distribution – Are tokens spread out fairly? Or is one whale holding half the supply?

- Development Activity – Frequent commits and updates? That’s a healthy sign of growth.

Why This All Matters

Projects can talk the talk, but on-chain data shows if they’re walking it.

A strong altcoin won’t just have a flashy website. It’ll have real users, steady activity, and smart token movement. Numbers don’t lie.

So next time you research a project, peek under the hood. Use tools like Etherscan, DeFiLlama, or Token Terminal. Track the signals. Because when you’re serious about how to analyze altcoin fundamentals, the blockchain itself becomes your best friend.

Tools and Platforms for Research: Your Altcoin Detective Kit

Alright, you’ve got the curiosity. Now let’s load you up with the right tools. Because if you’re serious about learning how to analyze altcoin fundamentals, you’ll need more than just good vibes and a whitepaper.

Start with Coin Aggregators

Websites like CoinGecko and CoinMarketCap are your go-to dashboards. You’ll find price charts, market cap, volume, token supply, and even basic project info.

Think of them as the Google Maps of the crypto world. A bird’s eye view before you zoom in.

Dig into On-Chain Data

Platforms like Etherscan, Solscan, or Arbiscan let you explore actual blockchain activity. Want to see real users, active wallets, or top token holders? This is where the data lives.

Bonus tip: High wallet concentration in a few hands? Maybe that altcoin isn’t as “community-owned” as it claims.

Check the Code and Commits

Developers leave clues. Use GitHub to peek into how often the project’s being updated. A lively repo usually means an active team. And active teams build stuff that matters.

Join the Crowd

Discord, Telegram, Reddit, X (formerly Twitter), these aren’t just for memes. They’re for vibes, updates, and seeing if there’s genuine community heat… or just bots and hype.

Final Tip

No single tool does it all. Use a mix. Cross-check everything. And most importantly, stay curious. That’s the real secret to how to analyze altcoin fundamentals like a pro.

Conclusion: Trust the Process, Not the Hype

Learning how to analyze altcoin fundamentals isn’t just a skill. It’s your superpower in a market full of noise.

Yes, it takes time. And yes, it can feel overwhelming. But every deep dive into a whitepaper, every check on a GitHub repo, every moment spent understanding tokenomics. It all adds up. You don’t need to be a blockchain wizard. Just stay curious. Ask better questions. Look beyond the surface. Because while others chase the next shiny coin, you’ll be building confidence, not just a portfolio.

So go ahead. Trust the process. Stay sharp. And remember: real fundamentals always outlast the hype.