Save More on Every Trade: Discover the Best Low-Fee Crypto Platforms This Year

Let’s be real—nobody likes paying fees. Especially when you’re trading crypto and every little percentage cuts into your gains. You’re here to make money, not give it away with every buy and sell.

But here’s the catch: not all crypto exchanges are built the same. Some sneak in fees that feel harmless at first… until you realize they’ve been nibbling away at your profits the whole time.

If you’ve ever looked at your wallet after a few trades and thought, “Wait, where did my money go?”—yeah, that’s probably the fees talking.

Good news though. There are exchanges out there that won’t drain your funds just for showing up. Some offer zero-fee trading. Others slash your fees if you use their tokens or hit higher volumes. And yes, they’re legit.

Whether you’re a total beginner still figuring out what “spot trading” means or someone who trades like it’s a full-time job, saving on fees is something everyone can get behind.

In this guide, we’re breaking down the top crypto exchanges with low fees in 2025. No fluff, no tech-speak. Just clear info that helps you trade smarter and keep more of what you earn.

Let’s dive in.

Why Trading Fees Matter

Trading crypto sounds exciting—buy low, sell high, make some cash. But there’s one thing quietly working against you: fees.

Every time you place a trade on a crypto exchange, you’re charged a small fee. It might look tiny—0.1% here, 0.2% there—but if you’re making regular trades, those small percentages add up fast. Like “where-did-my-profit-go” fast.

Let’s say you’re trading a few thousand dollars a month. That’s dozens of trades. And if your exchange charges high fees, it’s eating into your profits every single time you click “Buy” or “Sell.”

Now imagine you’re doing this every day or even just weekly. You could end up losing hundreds (or more) each year in fees alone. It’s like getting charged rent just to walk into a store.

Low-fee exchanges fix that. They give you a bigger slice of your earnings. That’s especially helpful if you’re trading on a budget or just starting out.

And here’s the kicker: lower fees don’t mean lower quality. Some of the most secure and advanced platforms in crypto also happen to have the best fee structures. So you’re not trading safety for savings—you’re getting both.

Bottom line: if you care about keeping more of your money (and who doesn’t?), trading fees matter. Choosing a low-fee platform is one of the smartest moves you can make, no matter your experience level.

Understanding Maker and Taker Fees

Before we get into which exchanges charge what, let’s clear up a common question: what’s the difference between maker and taker fees?

Short version:

- Maker = You wait.

- Taker = You jump in.

Let’s break that down.

What is a maker?

You’re a maker when you place an order that doesn’t get filled right away. Think of it like putting up an ad saying, “I’m selling Bitcoin at $40,000.” That order goes on the books and just sits there—waiting.

You’re “making” liquidity. That’s helpful to the exchange, so they usually reward you with a lower fee.

What is a taker?

You’re a taker when you grab whatever’s available right now. Like clicking “Buy” and accepting the best market price at that moment. Fast, easy, done.

You’re “taking” liquidity from the market, which means slightly higher fees.

Why does this matter?

Because depending on how you trade, you could be paying more than you need to. If you’re patient and place limit orders (maker), you’ll usually pay less in fees. If you’re going for speed with market orders (taker), expect to pay a bit more.

Here’s a quick comparison:

| Type of Trader | How It Works | Fee Level | Common Order Type |

| Maker | Places an order that doesn’t fill immediately | Lower fees | Limit order |

| Taker | Takes an existing order off the books instantly | Higher fees | Market order |

Quick Tip:

Most exchanges show maker and taker fees separately, and some offer discounts if you use their native tokens (like BNB on Binance or OKB on OKX). So even within the same platform, your fees can vary depending on how and what you trade.

Knowing the difference helps you trade smarter and keep more of your gains.

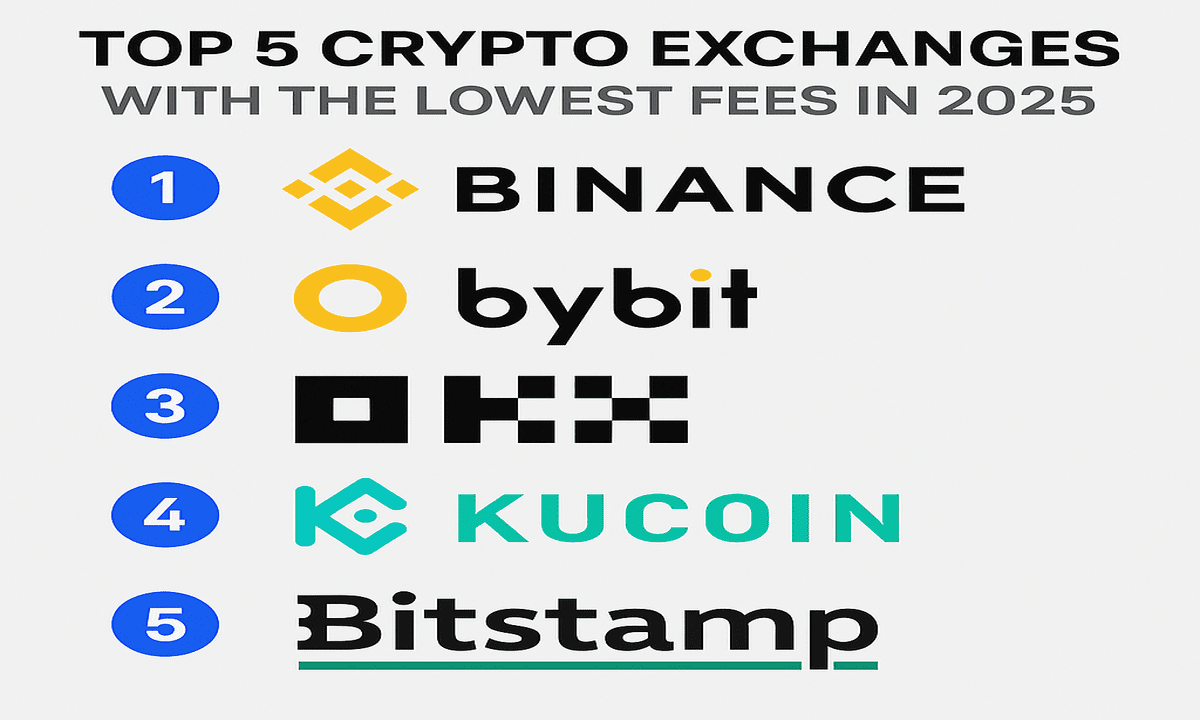

Top 5 Crypto Exchanges with Low Fees

When it comes to choosing a crypto exchange, low fees are a big deal—but they’re not the only thing that matters. Security, user experience, trading volume, and available features all factor in too.

The exchanges below strike the right balance. They offer competitive (sometimes zero) fees, but without cutting corners where it counts. Whether you’re a casual trader or someone with a full-blown spreadsheet habit, these platforms make sense.

Let’s get into it.

1. Binance – The Global Giant with Discounts for the Smart

Why it’s on top:

Binance is the largest crypto exchange in the world by trading volume. That matters, because high volume means better liquidity and faster trades. But what really sets Binance apart? It rewards smart users who want to cut costs.

Fee structure:

- Spot trading: 0.1% maker / 0.1% taker

- Fee discount: 25% off when paying with BNB (Binance Coin)

- VIP program: Lower fees based on volume

Why users love it:

- Deep liquidity across thousands of crypto pairs

- Tons of features: spot, margin, futures, staking, NFTs—you name it

- Advanced tools for pros, simple mode for beginners

- Heavy security with cold wallets, 2FA, and proof-of-reserves

Bottom line:

If you’re serious about crypto and want low fees plus every feature under the sun, Binance is tough to beat.

2. Bybit – Low Fees with a Clean, Pro-Friendly Interface

Why it’s on top:

Bybit started as a derivatives exchange but now offers spot trading too—still with killer low fees. It’s built with active traders in mind, but has an interface that doesn’t feel like you need a finance degree to use.

Fee structure:

- Spot trading: 0.1% maker / 0.1% taker

- Derivatives: 0.02% maker / 0.055% taker

- VIP levels: Tiered system with lower fees as you trade more

What makes it stand out:

- Great for both beginners and advanced users

- Fast trading engine and clean mobile app

- Strong focus on security (multi-sig wallets, 24/7 monitoring)

- Frequent bonus promos and deposit rewards

Bottom line:

Bybit is for people who want speed, low fees, and a platform that’s sleek without being stripped-down. It nails that balance.

3. Kraken – A U.S. Favorite Known for Transparency

Why it’s on top:

Kraken has been around since 2011. It’s one of the most trusted and regulated exchanges, especially for U.S. traders. While the fees are slightly higher than Binance or Bybit, the reliability, compliance, and fiat access make it a top pick.

Fee structure:

- Spot trading: 0.16% maker / 0.26% taker

- Fee reduction: Based on 30-day trading volume

- No deposit fees for most crypto assets

Why people trust it:

- Full U.S. compliance, great for regulated trading

- Strong fiat on-ramp options (USD, EUR, GBP, CAD, etc.)

- Clean interface with “Kraken Pro” for advanced users

- No history of major hacks or shady practices

Bottom line:

If you’re in the U.S. and want a secure, transparent platform with strong fiat support, Kraken is a solid choice—even if fees are slightly higher.

4. OKX – Deep Features and Big Fee Savings with OKB

Why it’s on top:

OKX (formerly OKEx) offers a powerful set of trading tools and products—plus fee discounts if you hold their native token, OKB. It’s a favorite among international users who want more than just spot trading.

Fee structure:

- Spot trading: 0.08% maker / 0.10% taker

- Discounts: Up to 40% off fees if you pay with OKB

- Advanced tiered system for high-volume traders

What makes OKX shine:

- Wide range of trading products: spot, futures, options, margin

- High liquidity and fast order execution

- Strong ecosystem with DeFi, NFTs, and yield farming

- Excellent mobile experience

Bottom line:

If you’re looking to go beyond basic trading—and you’re OK with holding OKB to save on fees—OKX delivers great value with serious tools.

5. MEXC – Zero-Fee King for Spot Traders

Why it’s on top:

MEXC doesn’t just talk about low fees—it removes them altogether. For spot traders, this is one of the few legit exchanges offering 0% trading fees without compromise.

Fee structure:

- Spot trading: 0% maker / 0% taker (yes, really)

- Futures: 0.01% maker / 0.05% taker

- No hidden charges or markups

Why it’s turning heads:

- Huge range of altcoins and lesser-known tokens

- Very beginner-friendly and fast to sign up

- Often first to list trending tokens and meme coins

- Regular zero-fee promotions and bonuses

Bottom line:

If you’re a spot trader looking to avoid fees altogether, MEXC is unmatched. It’s simple, clean, and doesn’t mess around with surprise charges.

Trading Platform Comparison

You’ve seen the individual breakdowns—now here’s how the top five low-fee crypto exchanges compare across the board.

| Exchange | Maker Fee | Taker Fee | Spot Fee Discount | Derivatives Trading | Best For |

| Binance | 0.1% | 0.1% | 25% off with BNB | Yes – Advanced Futures & Options | All-in-one powerhouse |

| Bybit | 0.1% | 0.1% | VIP level-based | Yes – Super low fees | Beginners + Active traders |

| Kraken | 0.16% | 0.26% | Volume-based | Limited | Regulated U.S. users |

| OKX | 0.08% | 0.10% | Up to 40% off with OKB | Yes – Full suite | Altcoin fans + DeFi users |

| MEXC | 0% | 0% | Not needed | Yes – Still low fees | Fee-conscious spot traders |

What This Means for You:

- Want zero fees? Go with MEXC. It’s unbeatable for cost-cutting.

- Need all the features? Binance gives you everything: spot, futures, staking, and great discounts.

- New to trading? Bybit makes things easy without giving up on pro tools.

- Live in the U.S.? Kraken keeps things compliant and safe.

- Looking for early altcoins and DeFi access? OKX gets you there with solid discounts.

A Few Extra Things to Consider:

- Liquidity matters. Binance, Bybit, and OKX all have high-volume markets, meaning better prices and faster trades.

- Security’s a must. All five have good reputations, but Kraken and Binance stand out for being battle-tested.

- User experience? Bybit and OKX have clean UIs and fast apps that don’t overwhelm you.

So it’s not just about the lowest number. It’s about which platform fits your style, your goals, and how often you trade.

Tips to Minimize Trading Fees

Low-fee exchanges are a great start. But if you really want to stretch your money, there are a few extra moves that can help you cut costs even more.

Here’s how to stay sharp and keep more of your profits:

1. Use Exchange Tokens to Pay Fees

Most top exchanges offer extra discounts if you use their native tokens to pay your trading fees.

- Binance: Use BNB to get 25% off spot trading fees.

- OKX: Use OKB to slash fees by up to 40%.

- Bybit: While there’s no token discount, VIP users with higher trading volume get tiered fee reductions.

Why this works: You’re essentially paying fees with a coin that costs you less, instead of dipping into your trading capital.

Pro tip: Don’t forget to toggle the setting to “pay fees using native token” in your account. It’s usually off by default.

2. Choose Limit Orders Over Market Orders

Remember maker vs. taker? Here’s where it pays off.

- Limit orders = lower fees (you’re a maker).

- Market orders = higher fees (you’re a taker).

If you’re not in a rush and can wait for the price to hit your target, limit orders save you money. Over time, those savings add up—especially for frequent traders.

Bottom line: Patience = smaller fees.

3. Take Advantage of Zero-Fee Promotions

Exchanges love to run promos—especially when listing new coins or pushing new features.

- MEXC frequently offers zero-fee trading across the board.

- Binance sometimes runs promos with 0% maker/taker fees for specific tokens.

- Bybit and OKX also host limited-time fee-free trading events, especially for new users or new trading pairs.

Watch out for:

- “First 30 days free” promos

- Welcome bonuses

- Referral programs that lower your fees

These are easy wins if you’re paying attention.

4. Level Up with VIP or Loyalty Programs

Most major platforms reward high-volume users with fee discounts.

- Bybit and Binance have VIP tiers based on your 30-day trading volume.

- OKX gives you better rates when you stake or hold more OKB.

- Kraken Pro lowers fees as your trade size increases over time.

Even if you’re not a heavy trader now, it’s worth knowing what volume milestones unlock better fees.

Pro tip: If you’re planning a large trade, doing it all at once might help you reach a higher volume tier faster.

5. Avoid Unnecessary Conversions and Withdrawals

Some exchanges sneak in small fees when you convert between currencies or withdraw crypto. Even if the trading fee is low, these extras can quietly eat into your balance.

- Always check the withdrawal fee list—it varies by coin and exchange.

- Try to consolidate trades to avoid excessive conversions.

- Use fee-free internal transfers when moving funds between sub-accounts or within the same exchange.

6. Know the Fee Structure Before You Trade

Every platform publishes its fee schedule. Read it. Bookmark it. Fees sometimes change based on:

- Trading volume

- Trading pair

- Your location

- Market conditions

Example: Some exchanges charge more for stablecoin pairs (like USDT/BTC) than fiat pairs (like USD/BTC). It pays to compare.

7. Consider Layer-2 Networks for Cheaper Withdrawals

Not a trading fee tip per se—but worth knowing.

Withdrawals on networks like Ethereum can be crazy expensive. Some exchanges offer cheaper alternatives:

- Use Polygon, Arbitrum, or Optimism instead of mainnet Ethereum.

- Check if your exchange supports fee-free transfers between wallets on Layer 2.

If you’re moving crypto off the exchange, this can save a ton.

Conclusion

Navigating the crypto world doesn’t have to mean sacrificing your profits to high trading fees. As highlighted in our guide to the 10 Best Cryptos to Buy Now, platforms like Binance, Bybit, Kraken, OKX, and MEXC stand out not just for their crypto selections, but also for their competitive fee structures. Whether you’re a beginner or a seasoned trader, understanding maker and taker fees, utilizing native tokens for discounts, and keeping an eye on promotional offers can help you maximize returns and minimize costs.

At Investors Collective, we believe in empowering our community with transparent, actionable insights. Our commitment is to provide you with the tools and knowledge needed to make informed decisions in the ever-evolving crypto landscape. Remember, in the world of cryptocurrency, staying informed is just as crucial as staying invested.

Disclaimer: Always conduct your own research and consult with financial advisors before making investment decisions.