Starting out as a crypto trader? Here are the beginner crypto trading mistakes to avoid when aiming for success in this space.

Diving into crypto for the first time feels like stepping into a wild digital frontier. It’s fast, exciting, and full of promise. But here’s the catch. It’s also easy to get burned.

There’s a reason so many newcomers end up with regrets. They rush in without a plan, fall for hype, or trust the wrong people. That’s why understanding the beginner crypto trading mistakes to avoid isn’t just helpful. It’s essential.

Whether you’re eyeing Bitcoin, exploring altcoins, or simply testing the waters, trading without awareness can cost more than just money. But don’t worry! This guide’s got your back.

We’ll walk through the classic traps, some sneaky ones you might not expect, and even talk about entry timing, scams, and the mindset you need to survive the crypto rollercoaster. Let’s help you trade smarter right from the get go.

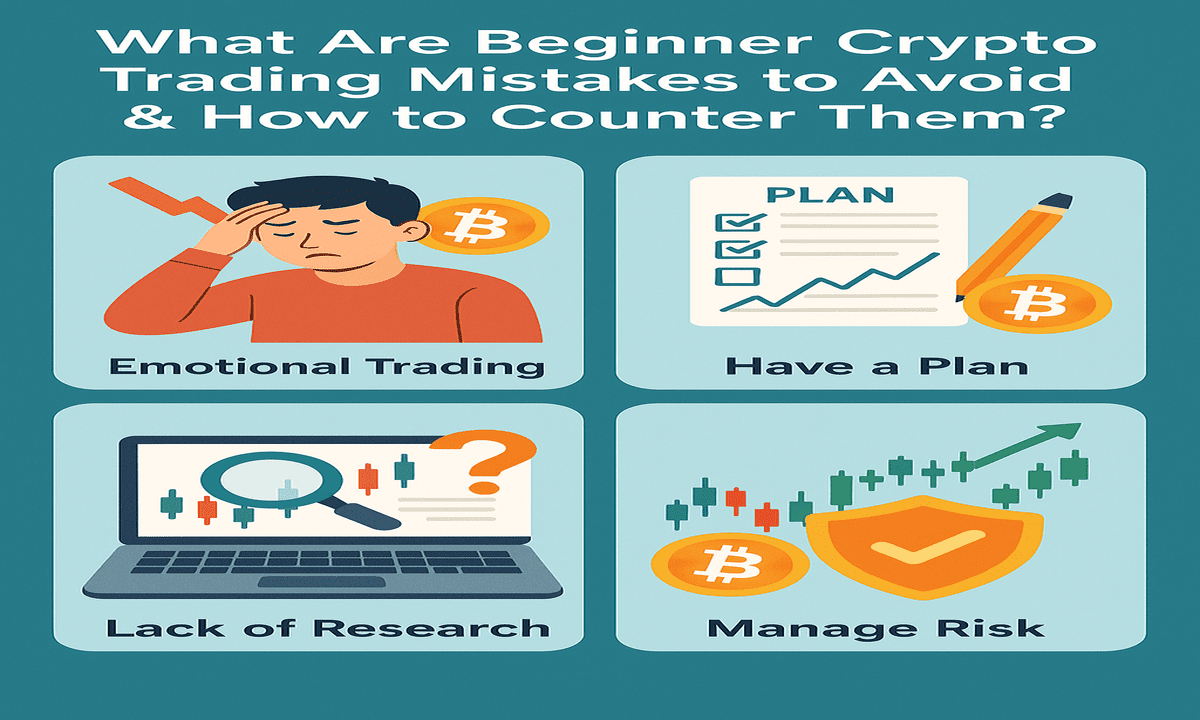

Common Pitfalls for Beginners to Avoid

Image by Steve Buissinne from Pixabay

So, you’re excited. You’ve got your first crypto wallet ready. Maybe a few coins already sitting pretty. And now you’re itching to make your first trade. Totally understandable.

But, before you dive in, let’s talk about the beginner crypto trading mistakes to avoid. These slip-ups might seem small at first, but they can seriously mess with your progress if you’re not careful.

Let’s break them down one by one.

1. Jumping In Without a Plan

Too many beginners treat crypto like a race. They want to jump in, buy something “trendy,” and hope it moons overnight.

But hope is not a strategy.

Start with a plan. Decide why you’re trading. Are you in it short-term or long-term? What’s your risk limit? Without a plan, you’re not trading. You’re gambling.

2. Following the Hype (And Getting Burned)

Social media is wild. One tweet and suddenly a random coin is shooting up 300%. Everyone’s talking about it. You don’t want to miss out.

So, you jump in. Only to watch the price crash minutes later.

This is classic FOMO (Fear of Missing Out), and it’s one of the most dangerous beginner crypto trading mistakes to avoid. Never buy based on hype. Always do your own research. If you’re hearing about a coin after it pumps, you’re already late.

3. Putting All Eggs in One Basket

You love a particular coin. Maybe it’s got a cool name or a strong community. So, you go all-in.

Big mistake.

Even the best coins can crash. Diversification is key. Spread your investment across a few solid projects. That way, if one fails, your portfolio doesn’t go down with it.

4. Ignoring Risk Management

This one’s huge.

Many new traders don’t set stop-losses or plan exits. They enter trades without any safety net. One bad move, and they lose everything.

So, set a maximum amount you’re willing to lose per trade. Use stop-loss tools. Don’t risk more than you can afford to lose. Managing your downside is just as important as chasing gains.

5. Overtrading

Crypto markets are open 24/7. It’s tempting to always be doing something. Buy here. Sell there. Check charts at 2 AM.

But more trades don’t mean more profits. In fact, overtrading usually leads to bad decisions driven by emotions. Not logic. So, take a breather. Stick to your plan. And remember, it’s okay to sit on the sidelines when the setup doesn’t look right.

6. Trading Without Understanding Technical Basics

Candlesticks. Resistance levels. RSI. Volume.

If these sound confusing, you’re not alone. But diving into trades without at least a basic understanding of charts is like driving blindfolded.

Take time to learn simple technical indicators. You don’t need to be a chart wizard, but spotting trends, support zones, and price patterns can give you an edge.

7. Falling for Fake Promises

“Guaranteed 10x in one week!”

“Send crypto to this wallet and get double back!”

“Join this secret group for massive gains!”

These are scams. Almost always.

Scammers prey on beginners. They look legit, sound convincing, and often hide behind fancy websites or fake influencer accounts. But the second you send your funds. It’s game over.

Stick to trusted platforms. Don’t trust anyone promising risk-free returns. And always double-check before clicking links or connecting wallets.

8. Forgetting to Secure Your Assets

This one often gets overlooked.

You’ve made your trades. You’re up a little. Things feel great. But all your funds are sitting on an exchange.

That’s risky.

Exchanges can get hacked. Or you might accidentally lose access. Always move your crypto to a private wallet, especially if you’re not actively trading. And never share your seed phrase with anyone. Ever.

9. Letting Emotions Drive Decisions

This one’s personal for many traders.

You see red candles and panic-sell. You see green ones and FOMO-buy. You let fear, greed, or impatience take the wheel.

But emotions are terrible decision-makers.

Set rules. Stick to them. And when in doubt, step away from the screen. You’ll make better moves with a calm mind than a frantic one.

10. Misunderstanding Crypto Market Entry Timing

Timing matters—a lot.

Buying into a pump? You’ll likely catch the top. Selling in a dip? You might lock in losses that could’ve been recovered.

New traders often buy too late and sell too early. Instead of guessing, learn to spot entry zones and wait for confirmation signals. Patience can be more profitable than speed.

11. Not Tracking Your Trades

Believe it or not, many beginners don’t track their trades. They forget how much they’ve lost, or worse. How much they think they’ve made.

Keep a simple spreadsheet or use tracking tools. Know what’s working, what’s not, and where your profits are really coming from. It makes refining your strategy a whole lot easier.

12. Thinking They’ve “Made It” After One Win

You made one lucky trade. It felt amazing. So, you start trading bigger. Risking more. Acting like a pro. And then the market humbles you.

One win doesn’t make you an expert. Stay grounded. Keep learning. And don’t let success blind you.

Ultimately, everyone makes mistakes. That’s part of learning. But the trick is to avoid the obvious ones. Those are the beginner crypto trading mistakes to avoid that we’ve laid out here.

The more mindful you are of these early traps, the better your foundation will be.

With that said, let’s look at some not-so-common pitfalls… the sneaky ones that even seasoned traders still fall for.

Not-So-Common Pitfalls for Beginners to Avoid

Image by Ryan McGuire from Pixabay

So, you’ve dodged the obvious traps. You didn’t ape into a meme coin. You’ve set stop-losses. You even resisted FOMO once or twice. That’s solid.

But let’s be honest. Crypto trading has a sneaky side. There are mistakes that traders make inadvertently. These aren’t loud and dramatic. In fact, they’re quiet. Subtle. And that’s exactly what makes them dangerous.

Let’s shine a light on these less talked-about, yet seriously costly, beginner crypto trading mistakes to avoid.

1. Relying Too Heavily on One Source of Information

Reddit threads, Twitter spaces, YouTube gurus. Everywhere you look, someone has a hot take.

The problem? Many beginners rely on just one. They follow a single “expert,” never cross-checking or digging deeper.

But crypto is complex. No one has all the answers. Always diversify your learning sources. Read whitepapers, watch tutorials, study charts, and follow credible analysts. Not just the loudest ones.

2. Ignoring Trading Fees and Hidden Costs

Every trade has a cost. It might not look huge at first. Maybe just a small percentage. But if you’re trading often, those little fees stack up quickly.

Beginners often forget this. They focus only on price action and forget to factor in gas fees, exchange charges, slippage, or even withdrawal limits.

Before hitting that “buy” or “sell” button, double-check the cost. Sometimes holding just a bit longer—or switching platforms—saves you money.

3. Using Too Much Leverage Without Truly Understanding It

Leverage is tempting. The idea of turning $100 into $1,000 sounds amazing. But here’s the catch. It can just as easily go the other way.

Many new traders jump into leverage without fully understanding margin calls or liquidation points. It’s easy to lose your entire position in minutes if the market turns.

So if you’re still learning the ropes, skip leverage for now. Focus on clean trades, not complex bets.

4. Over-Trusting Bots and Auto-Trading Tools

Yes, automation sounds cool. Bots can scan markets 24/7, run strategies, and take emotion out of trading. But they’re not magic.

Many beginners think bots are plug-and-play money machines. In reality, they require constant tweaking, understanding of market conditions, and risk controls.

Leaving a bot to run wild without monitoring? That’s a recipe for disaster. Use bots as tools. Not as shortcuts.

5. Getting Obsessed with Short-Term Charts

One-minute candles. Five-minute trends. Constant chart watching.

It’s easy to fall into the trap of micro-managing your trades. But obsessing over every little dip or spike can cloud your judgment.

Sometimes the real move plays out on the bigger timeframes. Daily and weekly charts tell a broader story. If you’re not a day trader, zoom out. Don’t let the noise shake your decisions.

6. Forgetting About Taxes (Until It’s Too Late)

This one hurts, especially when tax season rolls around.

Crypto profits count in many countries. And if you’re not tracking, you could be in for a shock. Some beginners trade all year, make solid gains, and then realize they owe a large chunk in taxes they didn’t set aside.

Keep records. Use crypto tax tools. Understand your local laws. Being proactive saves stress (and money) down the road.

7. Blindly Copying Portfolio Allocations

You see a pro trader sharing their portfolio on social media. It looks great. So, naturally, you copy it.

But here’s the thing: their strategy may not fit your goals, risk tolerance, or budget. They might be comfortable losing 30% in a bear swing. You might not be.

What works for them might not work for you. Build your portfolio based on your own research and comfort level. Not just what’s trendy.

8. Ignoring Community Sentiment

Sometimes, the charts look good, the news is quiet, and you think it’s the perfect entry point.

But if you’re not paying attention to community sentiment—Telegram, Discord, Reddit, X (Twitter)—you might be missing the full picture.

A sudden wave of fear or frustration in the community can tank a coin, even if the fundamentals look fine. Stay connected. Don’t trade in a bubble.

9. Believing Utility Automatically Equals Price Growth

A coin can have solid tech, great use cases, and still… go nowhere.

Why? Because utility doesn’t always translate to price, especially in the short term. Market perception, liquidity, and hype often outweigh actual fundamentals.

Beginners often think, “This project is useful, so the price must go up.” But the market isn’t that logical. Focus on both utility and momentum before jumping in.

10. Trading Just to “Do Something”

There’s this weird pressure to always be active. But trading out of boredom? That’s costly.

Some of the most successful traders do nothing for days. Sometimes weeks. They wait for clean setups. They don’t force trades. If you’re trading just because you’re bored, stop. Sit back. Review your past trades. Read. Learn. Waiting is often the smartest move.

Overall, these not-so-common mistakes don’t always shout at you. They creep in. They nibble away at your capital, your confidence, and sometimes your sanity.

But now that you know what to look out for, you’ve got a serious edge. The truth is, many beginner crypto trading mistakes to avoid exist in the gray zone. Not in the obvious red flags.

Next up, let’s talk about mindset. The trading philosophy that’ll actually carry you through the ups and the downs.

The Right Trading Philosophy for Beginners

Image by Fathromi Ramdlon from Pixabay

Crypto isn’t just about charts, candlesticks, or coin prices. At its core, successful trading is about mindset. You could have the best tools and still lose. Because your mindset wasn’t ready. So, let’s talk philosophy. The kind that keeps beginners grounded, focused, and one step ahead of costly blunders.

1. Play the Long Game

First things first. Don’t treat trading like a casino.

Yes, the market moves fast. Yes, people brag about overnight gains. But here’s the truth: most of them don’t mention their losses. The real winners? They think long-term.

Start small. Learn as you go. Let your strategy evolve. Don’t expect to “make it” in a week. That’s a mindset trap. And one of the easiest beginner crypto trading mistakes to avoid.

2. Learn Before You Leap

Don’t just follow the crowd. Take time to learn the basics. Understand how the blockchain works. Get familiar with terms like liquidity, market cap, and support/resistance.

You don’t need to be an expert, but a little knowledge goes a long way. And the more you understand, the less likely you’ll panic when prices dip or spike. So, read. Watch tutorials. Ask questions. Keep feeding your curiosity.

3. Accept That You Will Make Mistakes

Here’s a wild idea. Not every trade will be perfect. In fact, some will go terribly wrong. And that’s okay.

Mistakes are part of the process. What matters is what you do next. Do you blame the market and quit? Or do you reflect, adjust, and try again smarter?

Growth comes from trial and error. Just don’t repeat the same errors twice.

4. Don’t Trade Just to Trade

Sometimes the best move is no move at all.

New traders often feel the need to always be doing something. Buying. Selling. Flipping coins like it’s a game. But constant action doesn’t equal success. It usually leads to burnout and bad decisions.

Trade with intention. Wait for the right setups. Let your money sit patiently if needed. Boredom is not your enemy. Impulse is.

5. Detach Your Ego

The market doesn’t care about your predictions. It doesn’t owe you a win. And it definitely doesn’t follow your gut feeling.

Leave your ego at the door. If you get it wrong, admit it. Adjust. Move on. Being humble in this space isn’t weak. It’s wise.

6. Protect Your Capital First, Then Think Profit

This one’s huge.

Most beginners focus on how much they can make. But seasoned traders? They focus on what they can afford to lose. Because once your capital is gone, your learning stops.

Always think: “How do I stay in the game?” not just “How do I win today?”

With the right mindset, trading becomes less about luck. And more about skill, patience, and control. Now, let’s wrap things up and revisit what really matters when starting your crypto trading journey.

Final Checklist: Beginner’s Quick Survival Guide

Before you hit that “Buy” button again, pause. Breathe. And run through this quick survival guide. It might just save you from the most common (and costly) beginner crypto trading mistakes to avoid.

✅ Do Your Homework

Research the coin. Understand the project. Hype fades. Facts don’t.

✅ Use a Stop-Loss

Protect your capital. Always have an exit plan before entering a trade.

✅ Start Small

Don’t throw your life savings into your first trade. Ease in. Learn as you go.

✅ Keep Emotions in Check

Fear and greed are terrible advisors. Stick to your plan, not your feelings.

✅ Avoid Unknown Platforms

If it sounds shady, it probably is. Stick to trusted exchanges and tools.

✅ Secure Your Assets

Use wallets. Not your keys, not your coins. Period.

✅ Take Breaks

Staring at charts all day won’t help. Walk away. Refresh. Regroup.

Stick to this list, and you’ll trade smarter. Not harder. And more importantly, you’ll stay in the game long enough to actually win it.

Conclusion: Trade Smart, Stay Sharp

So, you’ve got the roadmap. The red flags. The right mindset. That’s a powerful combo.

Expert Crypto Market Analysis Today for 2025 reveals one clear truth: crypto trading can be wild—fast-paced, exciting, and occasionally frustrating. But with a bit of patience, a solid plan, and a keen eye for trends, you can steer clear of the common traps that catch most beginners off guard.

Success in trading isn’t about winning every single move. It’s about learning from each step, adapting with the market, and keeping your emotions in check. The key beginner crypto trading mistakes to avoid? You’ve got them now. And in this game, knowledge is power—and half the battle is already won.

Take your time. Stay curious. Trust the process. And when in doubt… Zoom Out!