Stay safe, stay smart—here’s how to protect your crypto investments without getting overwhelmed.

Let’s be real—crypto isn’t your average stock market. Prices can skyrocket one day and nosedive the next. One tweet can send a coin to the moon or straight into the dirt. It’s fast, exciting, and full of potential—but also packed with risk.

And here’s the thing: most people don’t think about risk until it’s too late. They go in hoping to double their money by the weekend, only to watch their portfolio melt like ice cream on a summer sidewalk.

But that doesn’t have to be your story.

Whether you’re just dipping your toes into Bitcoin or you’ve been around since the Dogecoin days, having a solid risk management game plan is key. It’s not about being scared. It’s about being smart. Knowing how much to invest, when to pull out, and how to protect your coins can save you from major regret later.

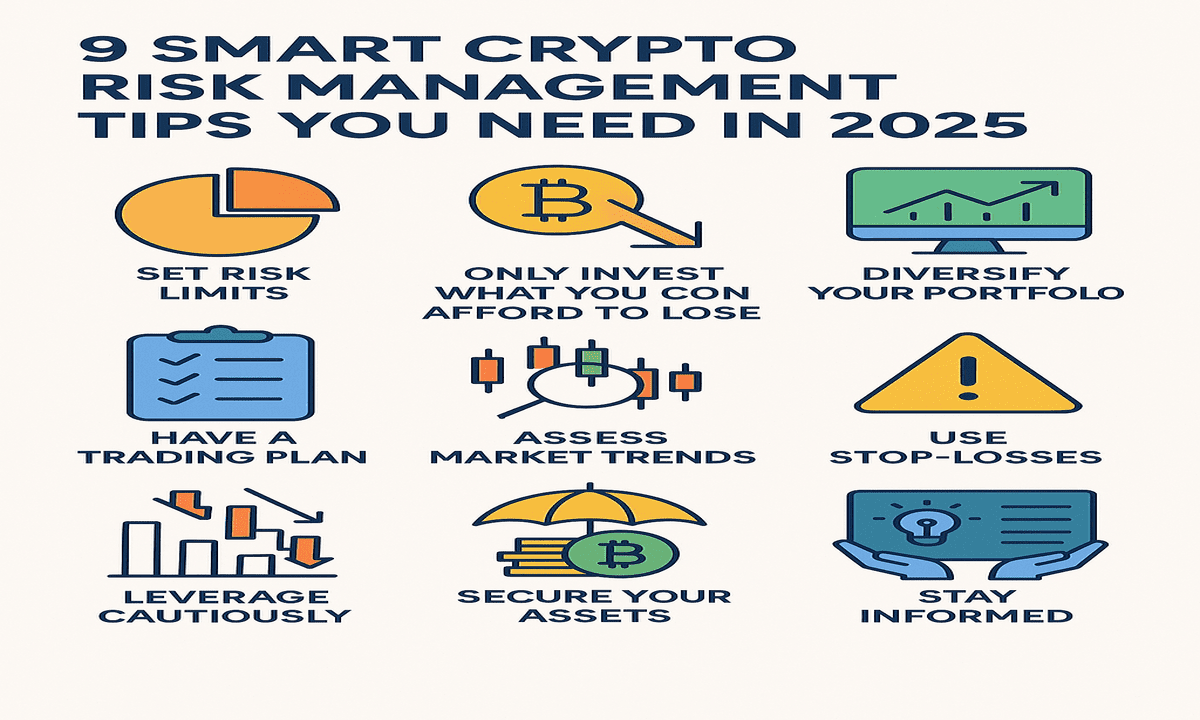

This guide breaks down the most important crypto risk management tips you need to know in 2025. No jargon. No hype. Just real, useful advice anyone can understand and actually use—no matter your experience level.

Let’s get into it.

Why Crypto Risk Management Matters in 2025

If you’ve been anywhere near the crypto space lately, you’ve probably seen two types of stories:

- The person who turned $500 into $50,000.

- The person who lost their savings chasing the next big thing.

Both started with the same tool—crypto. The difference? One had a plan. The other didn’t.

Risk management is that plan.

What’s Changed in 2025?

Crypto isn’t the wild west it was a few years ago. It’s still volatile, but it’s growing up. Regulators are paying attention. Institutions are getting involved. AI bots are trading faster than humans can blink. The stakes are higher now, and the speed of change is brutal.

In 2025, risk management isn’t optional—it’s survival.

Whether you’re holding coins long-term or jumping into day trades, the right strategy helps you avoid big losses and stay in the game long enough to actually win.

And here’s what people often get wrong:

Risk management isn’t about avoiding risk. It’s about knowing which risks are worth taking—and which ones will wreck you.

Common Crypto Risks (And Why They Matter)

| Risk Type | What It Means | Why You Should Care |

| Market Volatility | Prices swing fast and hard—up or down. | You can lose big money in minutes without a backup plan. |

| Scams and Rug Pulls | Fake projects that vanish with investor funds. | Happens more often than you think, especially with new coins. |

| Emotional Trading | Making decisions based on hype or fear. | Leads to buying high, selling low—classic loss recipe. |

| Poor Diversification | Putting all your eggs in one basket. | One crash could wipe you out. |

| Weak Security Practices | Bad passwords, no 2FA, clicking shady links. | Hackers love unprotected wallets. |

| No Exit Strategy | Holding “forever” without a plan. | You might miss profits or ride coins all the way down. |

Crypto gives you a shot at building real wealth—but it comes with real risks. The good news? You don’t need to be a pro to manage them. A few smart moves can go a long way.

Up next: we’ll get into those moves—starting with how much you should even invest in the first place.

Let’s keep it simple and smart.

Tip #1 – Set Clear Investment Limits

Let’s start with the most basic rule that way too many people ignore:

Never invest more than you’re willing to lose.

Sounds obvious, right? Yet thousands of people break this rule every day. They drain their savings, take out loans, or throw rent money into the latest trending coin hoping for a quick flip. And when it tanks? Game over.

Don’t be that person.

So, how much should you invest in crypto?

There’s no magic number, but here’s a solid rule of thumb:

Keep crypto as a small slice of your total net worth.

Somewhere between 1% to 10% is the range many smart investors use. If you’re just starting out, lean toward the lower end.

Set Personal Rules That Fit Your Life

Crypto is personal. Your risk tolerance isn’t the same as someone else’s. Here’s how to think about setting your own limits:

- Decide on a monthly cap – “I’ll only invest $200 per month.”

- Limit per project – “No more than 5% of my total crypto in one coin.”

- Set loss tolerance – “If I lose 15%, I stop trading for the week.”

The point isn’t to be rigid—it’s to stop yourself from making impulsive, emotional decisions that you’ll regret.

Example: Smart vs. Risky Investment Plan

| Investor | Monthly Budget | Risk Approach | Outcome |

| Smart Sarah | $300 | Invests 5% of net worth, spreads it across 3 solid coins | Sleeps well, learns slowly, stays in |

| Risky Ryan | $3,000 | All-in on one meme coin he found on TikTok | Rides hype, loses big, rage-quits |

One of them is playing the long game. The other is just gambling with extra steps.

Setting clear investment limits keeps you grounded. It protects your money and your mindset. And most importantly, it keeps crypto fun—without the gut-punch losses.

Next up: let’s talk about understanding your risk-to-reward ratio. That’s where things get interesting.

Tip #2 – Know Your Risk-to-Reward Ratio

This might sound fancy, but it’s really simple:

The risk-to-reward ratio tells you if a trade is actually worth it.

You’re basically asking:

“If I’m risking $100, how much could I realistically make back—and is it worth it?”

This one concept can separate smart investors from reckless ones.

What Is a Good Risk-to-Reward Ratio?

Let’s break it down with some basic math.

If you’re risking $100 on a trade and your goal is to make $300, that’s a 1:3 risk-to-reward ratio.

It means:

- If you’re right, you triple your money.

- If you’re wrong, you only lose $100.

Even if you’re only right 40% of the time, you’re still making money in the long run.

Now imagine the opposite: risking $300 to make $100. That’s just asking for trouble.

Why It Matters in Crypto

Crypto moves fast. It’s easy to get caught up in the hype of 10x coins and overnight gains. But without knowing your risk-to-reward ratio, you’re just guessing.

Here’s how smart investors use it:

- Before entering any trade, they ask:

“If this goes south, how much will I lose? If it goes right, what’s the upside?” - If the reward isn’t at least double or triple the risk, they walk away.

- No emotions. Just logic.

Real-Life Example: Simple Risk-to-Reward Setup

Let’s say you’re looking at buying Ethereum at $3,000.

- You set your stop-loss at $2,800 (your max risk = $200).

- Your target profit is $3,600 (your potential reward = $600).

Risk-to-reward = 1:3.

That’s a smart, calculated play.

But if your target was only $3,100 (just a $100 gain), your ratio flips. Now you’re risking $200 to make $100. That’s a no-go.

A Quick Visual Breakdown

| Trade Setup | Risk | Reward | Risk-to-Reward Ratio | Smart Move? |

| ETH buy @ $3,000 | $200 | $600 | 1:3 | Yes |

| BTC buy @ $60,000 | $1,000 | $1,000 | 1:1 | Maybe |

| New meme coin pump-in dump | $500 | $100 | 5:1 (in reverse) | Definitely not |

You don’t need to be a math nerd. You just need to know what you’re risking and what you stand to gain. If the numbers don’t make sense, walk away.

Next, let’s talk about something most people skip—your portfolio strategy. It’s not just for hedge fund bros. You need one too.

Tip #3 – Don’t Skip a Portfolio Strategy

A lot of people hear “portfolio strategy” and immediately check out. Sounds like something only a Wall Street type would care about, right?

Wrong.

If you’ve got more than one crypto coin, guess what?

You already have a portfolio.

The only question is—do you have a plan for it?

What Even Is a Portfolio Strategy?

Think of it like organizing your closet.

You don’t just throw everything in and hope it works. You separate it—work clothes, weekend stuff, gym gear. Your crypto should be the same.

A portfolio strategy is simply deciding:

- What kind of coins you hold

- How much you’re putting into each

- And why you’re holding them in the first place

That’s it.

Why It Matters

Without a strategy, people do two things:

- Chase every new shiny coin they see on Twitter.

- Hold everything forever, hoping something will eventually “moon.”

Neither works well in the long run.

But with a strategy?

You know what you’re investing in, how it fits into your bigger plan, and when to buy more—or cut it loose.

Simple Portfolio Strategy for 2025

You don’t need a spreadsheet with 12 tabs. Start with this:

- 60% in long-term holds (Bitcoin, Ethereum, solid projects you believe in)

- 30% in mid-risk altcoins (promising tech, strong teams, real use cases)

- 10% in high-risk plays (meme coins, hype tokens—only if you’re okay losing it)

This helps you ride the big waves, without sinking if one coin tanks.

Bonus Tip: Rebalance Regularly

If one coin blows up and now it’s 80% of your portfolio, don’t just let it ride. Take profits, spread the gains, and get back to your original mix.

This one move alone can help you lock in wins instead of watching them disappear.

The bottom line? A portfolio without a strategy is just a pile of coins. A little structure gives you way more control—and a better shot at long-term success.

Coming up next: one of the most overlooked parts of staying safe in crypto—loss prevention through education.

Tip #4 – Loss Prevention Starts with Education

Let’s be honest—most losses in crypto don’t come from bad luck.

They come from bad decisions.

And most of those bad decisions?

Come from not knowing what the hell you’re doing.

The #1 Cause of Avoidable Loss: Blind Hype

Here’s how it usually goes:

- A random token starts trending.

- Influencers call it the next big thing.

- Your group chat is buzzing.

- You FOMO in without even checking what it is.

- Boom—rug pulled. You’re stuck holding a worthless bag.

If this feels familiar, you’re not alone.

But it’s 100% preventable.

What “Education” Really Means (It’s Not a Course)

You don’t need a finance degree. You just need to:

- Google the project before you buy.

- Understand what problem it claims to solve.

- Check who’s behind it (and if they’re even real people).

- Look at the tokenomics—supply, utility, unlock schedules.

- Be skeptical of anything promising insane returns “guaranteed.”

If it sounds too good to be true, it probably is.

Where to Actually Learn (Without Getting Scammed Again)

Stick to credible sources, like:

- YouTube channels that teach, not hype

- Forums like Reddit (r/CryptoCurrency is a decent starting point)

- Crypto Twitter—but follow actual analysts, not meme lords

- Official whitepapers (yes, they’re boring—but they matter)

- Platforms like CoinMarketCap and CoinGecko for basic data

If you don’t understand something, don’t invest in it yet.

Simple as that.

One More Thing: Stay Curious

Loss prevention isn’t about memorizing terms. It’s about building instincts. The more you understand the space, the harder it becomes to fall for traps.

And the better your decisions get over time.

Tip #5 – Avoid Emotional Trading

Image credit: SBS

This one hits hard because we’ve all been there.

You check your phone. Your favorite coin is pumping. Everyone’s tweeting rocket emojis. You don’t want to miss it—so you jump in.

Then… it dumps. Hard.

Now you’re panicking. You sell to “cut losses.” The price rebounds the next day.

Now you’re mad and broke.

That’s emotional trading. And it’s one of the fastest ways to wreck your portfolio.

Why Emotion Is Your Worst Investment Partner

The crypto market runs on emotion. FOMO (fear of missing out). FUD (fear, uncertainty, doubt). Hype. Panic. Repeat.

If you react to every pump or dump with your gut instead of your plan, you’re not investing—you’re guessing.

And in crypto, guessing is expensive.

How to Keep Emotions Out of It

You can’t turn off feelings—but you can keep them out of your trades. Here’s how:

- Use a plan, not your gut. Set buy/sell targets before you enter a trade. Stick to them.

- Take breaks. Don’t stare at charts all day. The more you watch, the more likely you’ll do something dumb.

- Zoom out. Ask yourself: will this decision still make sense next week? Next month?

- Limit screen time during volatility. If your coin is tanking, walk away. You’re more likely to make a smart call with a clear head.

What Emotion-Free Trading Looks Like

It’s boring. And that’s a good thing.

You’re not chasing every pump. You’re not panic selling on dips. You’re following a strategy, not the crowd.

The best traders?

They’re calm. Detached. Sometimes even kinda lazy.

And that’s exactly how they win.

Coming up next: we’ll talk about something practical you can do right now to bring structure to your trades—stop-loss and take-profit orders.

Tip #6 – Use Stop-Loss and Take-Profit Orders

Image credit: Stock Sharp

If you’re trading without stop-losses or take-profits, you’re basically walking a tightrope with no safety net.

These two tools won’t guarantee profits, but they will protect you from your worst instincts—panic, greed, and “just one more minute” syndrome.

What’s a Stop-Loss?

A stop-loss is a pre-set price where your position automatically sells if the coin drops.

Think of it as the emergency exit.

You decide ahead of time, “If this drops below $X, I’m out.”

It saves you from holding a loser all the way down while you “hope it comes back.”

What’s a Take-Profit?

Same idea, flipped.

You set a price where you lock in gains when the coin hits your target.

You don’t sit there watching your profit rise and fall because you got greedy and didn’t sell.

It’s a simple way to secure wins before they vanish.

Why These Tools Matter (Especially in Crypto)

Crypto moves fast. Prices can swing 20% in minutes. If you’re asleep, at work, or just not paying attention, you can miss your window to react.

With stop-loss and take-profit orders, your trades manage themselves—even if you’re not watching.

Quick Example: How They Work Together

Let’s say you buy Solana at $150.

- You set a stop-loss at $135. If it drops, you’re out with a $15 loss.

- You set a take-profit at $180. If it pumps, you lock in $30 per coin.

You’re no longer guessing. You’ve created a smart, balanced plan.

Pro Tip: Don’t Over-Tweak

Once you set these orders, leave them alone. Constantly moving them around defeats the purpose. You’re trying to trade with discipline—not chase every tick.

Now we know how to use stop-loss and take-profits method, let’s talk diversification—how to spread your bets without losing your mind (or your money).

Tip #7 – Diversify, But Not Too Much

Image credit: Crypto Blogs

You’ve probably heard it a hundred times:

“Don’t put all your eggs in one basket.”

That’s solid advice. But here’s the part people miss:

Don’t put your eggs in a hundred baskets either.

Diversification protects you from total disaster—but too much of it can just leave you confused, stretched thin, and holding 27 coins you don’t even remember buying.

Why Diversification Helps

Crypto is unpredictable. One coin can soar while another tanks.

Spreading your investments helps you survive those ups and downs.

If one coin crashes, the others can help balance the blow.

If one pumps, it pulls your whole portfolio up with it.

Simple. Smart.

But More Isn’t Always Better

Beginners often go overboard. They buy every project that looks interesting. Meme coin here, AI token there, some random thing called “CryptoFart 2.0” because it’s trending.

Now they’re tracking 20 different coins and don’t understand a single one.

That’s not a strategy. That’s chaos.

How to Diversify the Right Way

- Stick to a small number of coins you actually believe in.

Think 5 to 8 solid picks—not 30. - Mix risk levels:

A few large caps (Bitcoin, Ethereum), a few mid-caps, maybe one or two high-risk plays. - Don’t overlap too much:

If five of your coins all depend on the same tech or sector, that’s not true diversification.

Ask This Before Buying Any Coin:

“How does this fit into my overall plan?”

If you can’t answer that in one sentence, don’t buy it—yet.

Diversification is about building a strong, balanced foundation—not chasing every shiny object that pops up on your feed.

Clear so far? Let’s discuss how to actually keep your crypto safe, because all the planning in the world means nothing if you get hacked or scammed.

Tip #8 – Keep Your Coins Safe (Security Basics)

You’d be surprised how many people focus on buying the right coins, timing the market, building the perfect strategy…

Then lose everything because they clicked a sketchy link or reused a weak password.

Security isn’t optional. It’s not “nice to have.”

It’s the line between staying in the game or getting wiped out overnight.

Hot Wallet vs. Cold Wallet: Know the Difference

- Hot Wallets are online—connected to the internet. Think MetaMask or exchanges like Coinbase.

- Super convenient.

- Also, the main target for hackers.

- Super convenient.

- Cold Wallets are offline—like hardware wallets (Ledger, Trezor).

- Not connected to the internet = way safer.

- Perfect for long-term storage.

- Not connected to the internet = way safer.

If you’re holding more than lunch money in crypto, you need a cold wallet.

Basic Security Moves You Shouldn’t Skip

- Use two-factor authentication (2FA) – And not the SMS kind. Use an authenticator app.

- Create strong, unique passwords – No “Bitcoin123.” No birthdays. Use a password manager.

- Never click random links – Especially in Discords, Telegram groups, or shady emails.

- Don’t brag online – The more people know you hold crypto, the more you become a target.

- Double-check wallet addresses – Malware can swap copy/paste addresses in the background.

- Back up your seed phrases – Write them down. Keep them offline. No screenshots, no cloud storage.

Security Is Boring—Until You Need It

It’s not flashy. It doesn’t get clicks. But it keeps your coins where they belong—with you.

Don’t wait until after a hack to take this stuff seriously. Be the person who took five minutes to secure their assets instead of the one tweeting about losing everything.

Last but not least, let’s look at the mindset that ties everything together—thinking long-term and staying informed.

Conclusion

Navigating the crypto market without a solid risk management strategy is like sailing through stormy seas without a compass. For the Crypto Investor Community in 2025, having a well-defined plan is essential. By setting clear investment limits, understanding your risk-to-reward ratio, diversifying your portfolio wisely, and prioritizing asset security, you can safeguard your investments and build a foundation for long-term growth. Remember, the goal isn’t to eliminate risk entirely—it’s to manage it strategically and smartly.

For those seeking deeper insights and strategies, Investors Collective offers comprehensive discussions on risk management in crypto investing. Their resources emphasize the importance of education, diversification, and utilizing tools like stop-loss orders to safeguard your portfolio.

Stay informed, stay disciplined, and always invest with a clear strategy in mind.