Let’s explore how businesses use crypto today to save costs, speed payments, and stay ahead.

Remember when crypto was just this wild idea on the internet? At first, it was all about Bitcoin millionaires and digital gold rushes. People bought coins, sold coins, and hoped to get rich overnight. It felt more like gambling than strategy.

But times have changed.

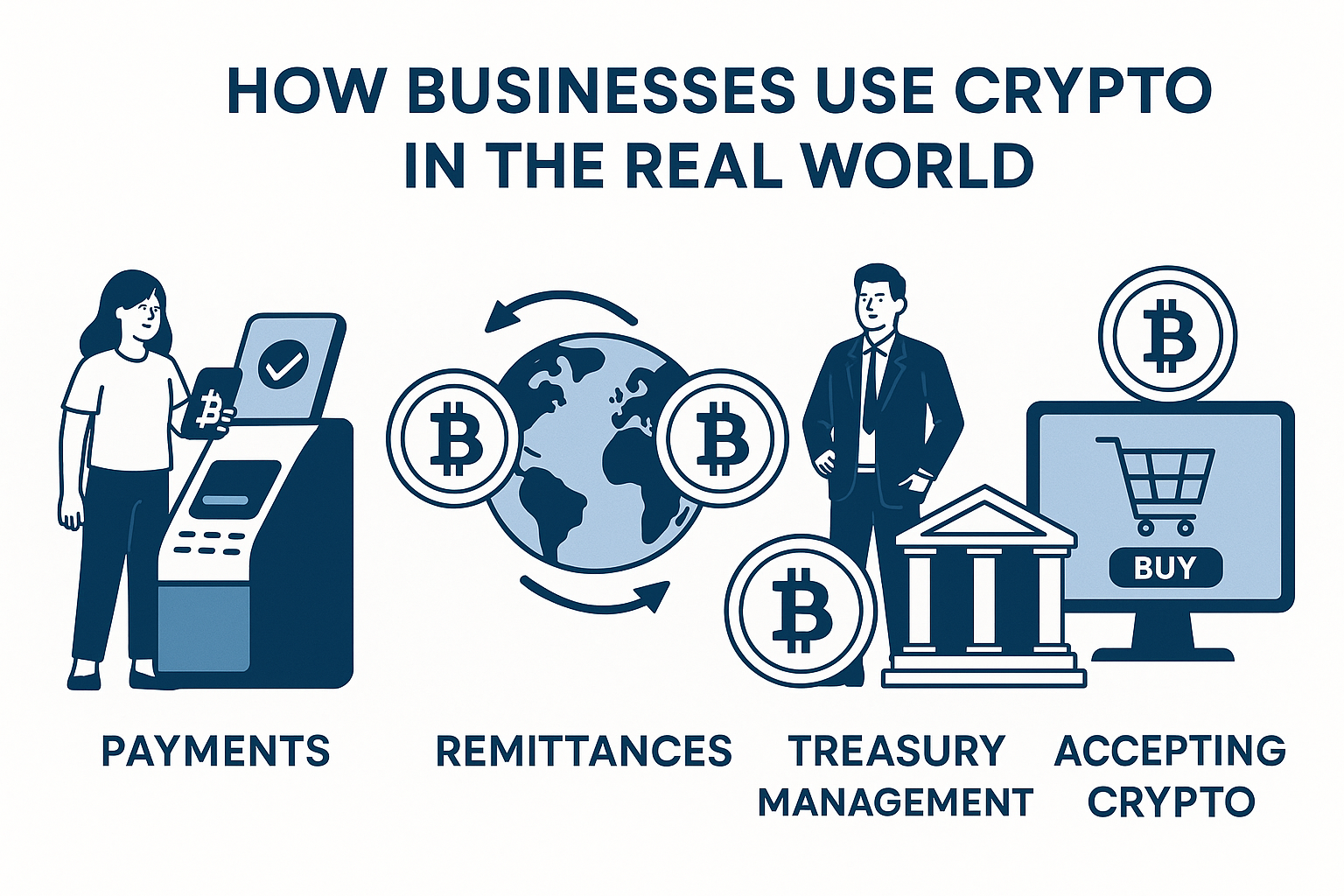

Now, the conversation is shifting. It’s no longer just about speculation. Today, we’re seeing something different—how businesses use crypto to solve real problems, speed up transactions, and open doors to global markets. From blockchain in real estate to crypto payment modes, businesses are innovating.

Today, we’re diving deep into that transformation. We’ll explore how companies are using crypto in everyday operations. We’ll look at blockchain solutions, smart contracts, and real-life success stories. Most importantly, we’ll break it all down in simple terms.

Because the future? It’s already happening. And it’s digital.

The Rise of Cryptocurrency for Business Transactions

Photo by André François McKenzie on Unsplash

Once considered futuristic, paying with crypto is now becoming as normal as tapping your card. From Bitcoin and Ethereum to stablecoins like USDC and USDT, digital currencies are steadily weaving themselves into the way we do business.

From Wallets to Checkout: Crypto at the Register

More and more companies are starting to say, “Sure, we take crypto.” Whether it’s Bitcoin for a coffee or Ethereum for online software, digital payments are no longer a niche.

Why? Because they make sense.

Businesses don’t just want speed. They need it. Crypto transactions happen almost instantly, especially across borders. No waiting for bank approvals. No middlemen slowing things down. Just fast, direct payments that feel like magic.

And let’s not forget about the fees. Traditional banking systems often charge hefty fees for international payments. Crypto cuts that down. Sometimes, it’s pennies on the dollar. Plus, fraud becomes much harder thanks to blockchain’s transparent, secure structure.

So, when we ask how businesses use crypto, the first answer is simple: they use it to get paid smarter.

Big Brands, Bold Moves

You might think only edgy startups or tech geeks are jumping into crypto. Think again.

Tesla shook headlines when it accepted Dogecoin. Shopify gives merchants the option to accept crypto payments. Microsoft? They’ve been dabbling in Bitcoin since way back in 2014. For Xbox and digital content.

These aren’t just stunts. They’re signals.

When global companies start accepting digital currencies, it’s not just about headlines. It’s about setting a new standard for how money moves.

A Global Payment Revolution in Motion

The way businesses handle money is changing. Slowly, but surely.

Whether you’re running a café or managing a tech empire, the benefits of crypto are hard to ignore. Speed, cost, and security all rolled into one. And as tools and regulations improve, this trend is only picking up speed.

So if you’re wondering how businesses use crypto in real life. It often starts right at the checkout.

Crypto Adoption in Business: Who’s Leading the Way?

Crypto isn’t just for tech nerds and traders anymore. It’s quietly (and quickly) becoming a practical tool for everyday businesses. Across industries, from retail to real estate, we’re seeing a new kind of digital shift. One that’s less about hype. And more about action.

So, who’s jumping in first? And why?

Industries Taking the Leap

Some sectors are diving headfirst into crypto, while others are still dipping their toes.

Fintech is obviously leading the charge. These companies live and breathe digital finance, so adding crypto to the mix just makes sense. They’re building crypto wallets, launching exchanges, and creating tools for businesses to send, receive, and manage crypto like pros.

Retail is right behind. Both online and brick-and-mortar stores are accepting Bitcoin, Ethereum, and even stablecoins like USDC at checkout. It’s all about offering more payment options and reaching younger, tech-savvy buyers.

Then there’s real estate. A bit of a surprise, but a powerful one. From tokenized property shares to full-on crypto property sales, this old-school industry is finding new life in digital payments. Finally, the freelance economy is loving crypto. No more waiting weeks for wire transfers. Freelancers across the globe now get paid in minutes, not days.

Startups vs. Giants: Who’s Faster?

When it comes to adopting crypto, startups usually move faster. They’re agile. They don’t have layers of red tape or outdated systems to deal with. Many are even building their business models around crypto from day one.

But don’t count out the big guys.

Corporations like PayPal, Visa, and even Starbucks are experimenting with crypto in their own ways. Whether through payment systems, loyalty programs, or crypto-backed cards. They may move slower, but when they move, they move big.

So, whether it’s a two-person tech startup or a global brand, the momentum is definitely building.

Crypto-Friendly Services Are Booming

As more companies join the crypto club, support services are popping up everywhere.

Want to pay your team in Bitcoin? There’s a tool for that. Need to send a crypto invoice to a client in Singapore? Easy.

We’re seeing a wave of platforms offering crypto payroll, invoicing, accounting tools, and even employee benefits. These services remove the friction and make using crypto in business feel as easy as using traditional money. Sometimes easier.

A Global Wave, with Hotspots

Crypto adoption isn’t happening in just one place. It’s a worldwide movement. But some regions are racing ahead.

Latin America, for instance, is seeing massive crypto growth due to inflation and currency instability. Countries like El Salvador are even adopting Bitcoin as legal tender. Asia (especially Singapore and South Korea) is embracing blockchain tech, crypto innovation, and regulation simultaneously.

Meanwhile, the US and Europe are seeing steady adoption. Especially in tech hubs and among forward-thinking enterprises.

The Future Is Already Here

So, when we ask how businesses use crypto, the answer is everywhere and growing. From paying freelancers in Nigeria to buying homes in Miami, the crypto wave is crashing into all corners of the economy.

And guess what? This is only the beginning.

How Businesses Use Crypto: Blockchain Solutions for Enterprises

Image by Gerd Altmann from Pixabay

So, we’ve talked about crypto as payment. But let’s peel back another layer. Because beneath the coins and tokens lies the real game-changer: blockchain. It’s not just about money. It’s about trust, transparency, and doing business in a smarter way.

What Is Blockchain (and Why Should Businesses Care)?

Think of blockchain as a super-smart digital notebook. It records transactions, locks them in place, and doesn’t let anyone sneak in and change the story. Every block in the chain is like a page in that notebook. Timestamped, verified, and shared across a network.

Why does this matter to businesses?

Because it means no more shady edits. No more lost records. No more “he said, she said” in supply chains or contracts. Just clean, secure, and visible data. Available in real time. For businesses looking to cut costs, build trust, and ditch the middlemen, blockchain isn’t just cool. It’s practical.

Real-World Use Cases: More Than Just Buzzwords

Let’s look at where blockchain is actually doing work.

Supply chain management: Imagine being able to trace a product’s journey from raw material to store shelf, with zero guesswork. That’s the power of blockchain.

- Smart contracts: These are digital agreements that execute themselves. No need for lawyers or third parties. The code handles everything. Fast, fair, and automatic.

- Data integrity: Information stored on the blockchain can’t be changed without everyone knowing. That’s a win for industries that rely on audits, records, and compliance.

- Logistics: From tracking shipments to verifying inventory, blockchain adds a layer of clarity logistics teams never had before.

It’s not just theory. It’s already happening.

IBM + Walmart = Blockchain on Your Plate

Here’s a real story that brings it all to life.

Walmart teamed up with IBM to build a blockchain system called Food Trust. The goal? Track food items from farm to store in seconds, not days. Before blockchain, tracing the source of a bad batch of lettuce could take a week. With blockchain? Two seconds.

That’s not just efficiency. That’s lives saved, waste reduced, and trust restored. It shows how businesses—especially large ones—can use blockchain to solve very real problems.

The Pros and the Bumps in the Road

Of course, nothing’s perfect.

On the plus side, blockchain offers transparency, security, automation, and fewer third-party headaches. It can streamline operations and boost customer confidence.

But challenges exist too.

Big companies often struggle with old systems that don’t “talk” to blockchain easily. There’s also a steep learning curve, and let’s not forget the regulatory uncertainty that still hovers in many regions.

Even so, the momentum is growing. As tech gets better and costs come down, more enterprises are jumping in.

The Bigger Picture

So, if you’re still wondering how businesses use crypto, this is a huge part of it. They’re not just using digital coins. They’re building better systems on blockchain. And honestly? They’re just getting started.

How Businesses Use Crypto: Stablecoins, CBDCs, and Business Stability

Photo by CoinWire Japan on Unsplash

Bitcoin might be the most famous kid in the crypto playground, but when it comes to stability, it’s not always the most reliable friend. That’s where stablecoins and CBDCs step in, offering a calmer, more predictable ride for businesses ready to embrace digital money.

Why Stablecoins Are Winning Over Businesses

So, what exactly are stablecoins?

In simple terms, they’re cryptocurrencies tied to something stable. Usually a fiat currency like the U.S. dollar. Think of USDC and USDT. They don’t swing wildly like Bitcoin or Ethereum. Instead, they’re designed to hold their value.

For businesses, that’s a big deal.

Imagine running an online store. You accept Bitcoin for a $100 product. By the time you cash it out? It’s worth $82. Ouch. Stablecoins remove that guesswork. What you see is (mostly) what you get. Plus, they still bring all the crypto benefits—fast transactions, global reach, and lower fees—without the heartburn.

That’s why more and more businesses are using stablecoins for payroll, invoices, cross-border payments, and even subscriptions. It’s predictable. It’s efficient. It just works.

Crypto Volatility vs. Stablecoin Simplicity

Traditional cryptocurrencies are powerful, but they’re also… dramatic.

Prices can jump or crash in a single tweet. Great for traders, not so great for everyday business owners trying to balance books or pay rent. That’s where stablecoins really shine. Their value stays locked. No sudden surprises. This makes them perfect for real-time financial planning and reliable payment systems. And the best part? You still get that digital, borderless speed—but with none of the chaos.

So, when people ask how businesses use crypto without all the risk, stablecoins are the answer many are turning to.

Enter CBDCs: The Government Joins the Chat

Now, let’s zoom out a bit. Governments around the world have been watching the crypto rise. And many are now building their own versions of it. They’re called Central Bank Digital Currencies, or CBDCs.

Think of them as digital dollars, euros, or yuan. Issued by a central bank. Backed by the state. And yes, totally digital. What could this mean for businesses?

Well, imagine being able to pay taxes, settle invoices, or handle compliance digitally, instantly, and securely. All using a currency your government recognizes and regulates.

CBDCs could reduce banking fees, simplify accounting, and even improve financial inclusion for small businesses. Countries like China are already testing CBDCs in real-world scenarios, while others like the UK and EU are in research mode.

It’s early days, but the direction is clear: digital money is going mainstream.

A More Stable Future

So, whether it’s stablecoins today or CBDCs tomorrow, one thing is clear—how businesses use crypto is evolving fast. It’s no longer about chasing price highs. It’s about creating stable, smart systems that work in the real world.

And these digital dollars? They might just be the bridge between crypto dreams and business reality.

How Startups Are Leveraging Crypto to Scale

Photo by RDNE Stock project

Startups have always been about breaking the rules. Or at least bending them in clever ways. So, when crypto showed up with its open systems, fast transactions, and decentralized power? You bet startups jumped on it.

And truth be told, they’re not just using crypto. They’re scaling with it.

New Ways to Raise Money: ICOs, STOs, and DAOs

Back in the day, raising funds meant pitching to VCs, filling out mountains of paperwork, and crossing fingers. But now? Crypto offers a new game.

Initial Coin Offerings (ICOs) allow startups to raise money by selling tokens. Kind of like digital shares, but with built-in perks. It’s fast, global, and often cheaper than traditional funding rounds.

Security Token Offerings (STOs) take it a step further. They offer tokens that are legally recognized as securities. More rules, yes. But more investor trust too.

And then, there’s the wild world of DAOs. Decentralized Autonomous Organizations. Here, funding comes from communities. The crowd doesn’t just back your idea. They govern it.

For startups, this opens up a brand-new fundraising frontier. One where anyone, anywhere, can be part of your mission.

Tokens as Incentives: Engage, Reward, Repeat

Startups love growth hacks. And crypto just handed them a powerful one. Utility tokens.

Think of them as digital coins with a purpose. You give them to users for taking actions. Signing up, sharing content, making purchases. It’s like gamifying your entire business model.

Users feel involved. They earn something real. And better yet, they’re more likely to stick around. It’s not just about points or badges anymore. It’s about ownership and value. This is how businesses use crypto not just to grow their audience. But to build loyal, invested communities from day one.

Smarter Loyalty Programs (Thanks, Blockchain)

Speaking of loyalty. Blockchain is flipping the script there too.

No more outdated punch cards or points lost in cyberspace. Instead, startups are building blockchain-based loyalty programs that are transparent, secure, and transferable. Yes, transferable. Imagine earning rewards from a coffee app and using them on a partner bookstore. All powered by smart contracts and blockchain logic.

That’s not future talk. It’s already happening. Startups are using crypto tech to create ecosystems, not just apps. And customers? They’re loving it.

Decentralized Platforms: A Startup’s Playground

Want to launch a marketplace without middlemen? Welcome to Web3.

Startups are leveraging platforms like OpenSea (for NFTs) and Uniswap (for decentralized trading) to reach users directly. No gatekeepers. No red tape. They’re building on top of protocols, not platforms. They’re launching tools that live entirely on blockchain.

This shift is huge. It’s letting startups move faster, build cheaper, and scale globally. Without asking permission. And as more of these decentralized tools emerge, expect to see even more creative ideas take shape.

From token-powered growth hacks to loyalty programs that actually reward loyalty, the startup world is showing us exactly how businesses use crypto to unlock new levels of speed, scale, and freedom.

Tax, Accounting & Legal Considerations for Businesses Using Crypto

Photo by Nataliya Vaitkevich

Crypto can feel like the Wild West. It’s exciting, fast-moving, full of opportunity… but also, a little unpredictable. Especially when it comes to the not-so-glamorous side of doing business: taxes, accounting, and legal stuff.

Still, if we’re talking about how businesses use crypto, we can’t skip this part. Because making crypto work behind the scenes is just as important as using it upfront.

Crypto on the Balance Sheet: Not Just HODLing

When a business accepts Bitcoin or holds stablecoins, those digital assets don’t just disappear into thin air. They land on the balance sheet.

But here’s where things get interesting: crypto isn’t treated like cash. In most countries, it’s considered property. That means every fluctuation in value could trigger a taxable event. Companies need to track the price at the time of each transaction. Buying, selling, even holding. It’s like accounting with turbo mode switched on.

Some businesses simplify it by converting crypto to fiat right away. Others—especially those bullish on the future—hold onto it. Either way, it takes careful planning to keep the books clean and accurate.

Crypto and Taxes: It’s Complicated (But Doable)

Now for everyone’s favorite topic: taxes. The truth is, tax authorities around the world are still figuring this out. Regulations vary wildly by region. And they keep evolving.

For example, in the U.S., the IRS requires businesses to report crypto gains and losses. In the UK, HMRC has detailed (and growing) guidelines for crypto-related activity. Meanwhile, some countries are offering tax breaks to attract crypto startups.

So what’s a business to do?

First, stay updated. Crypto tax rules change fast.

Second, get help. Working with crypto-savvy accountants or tax advisors can save you a lot of stress (and potentially, a lot of money).

And third, track everything. Every wallet. Every transaction. Every conversion. The more organized you are, the smoother tax season will be.

Smart Tools for Smarter Accounting

Thankfully, you don’t have to do all this manually. A growing number of tools make crypto accounting and auditing a breeze. Or at least, less painful.

Platforms like CoinTracker, Koinly, and Bitwave connect to wallets and exchanges to automate record-keeping. They handle real-time valuations, generate tax reports, and even integrate with traditional accounting software like QuickBooks and Xero.

For auditing, blockchain actually makes things easier. Every transaction is transparent and timestamped. That means less guesswork. And more accountability.

Legal Grey Areas and How to Navigate Them

Even with tools and tax strategies in place, the legal landscape remains a bit murky. Is that utility token you gave away considered a security? Is your DAO governed by law in your country?

The answers aren’t always clear. To manage risk, businesses are:

- Working with crypto-focused legal teams

- Setting up shop in jurisdictions with clear crypto regulations

- Building internal compliance protocols to stay ahead of any legal curveballs

Bottom line? There’s a lot to think about. But none of it is impossible. In fact, as more businesses figure it out, we’re getting closer to a world where crypto is just another (normal) part of business.

The Future of B2B Payments and Smart Contracts Using Crypto

Image by freepik

Business is built on agreements. You provide a product or service, I pay you. Simple, right? But in reality, things get complicated. There are delays, middlemen, disputes, and piles of paperwork. That’s exactly where crypto, and especially smart contracts, start to shine.

So if you’re wondering how businesses use crypto to make things smoother, faster, and cheaper… this is where the magic happens.

Business-to-Business, Without the Banks

Traditional B2B payments are often slow and expensive. Cross-border transfers can take days, sometimes even longer. Fees stack up, and so do the headaches.

Now imagine this: Company A in London sends payment to Company B in Tokyo. No banks. No intermediaries. No delays. Just a peer-to-peer crypto payment that clears in minutes. That’s not science fiction anymore. With Bitcoin, Ethereum, and even stablecoins like USDC, businesses can send money directly. Globally, and almost instantly.

It’s already happening in tech, e-commerce, and freelance marketplaces. And it’s not just startups. Larger firms are starting to realize the potential, especially when dealing with international vendors or remote teams.

Enter Smart Contracts: Code That Keeps Promises

While fast payments are great, automation is even better. That’s where Ethereum smart contracts come in.

A smart contract is a piece of code that runs on the blockchain. It executes automatically when conditions are met. No one can change it once it’s live. No need to chase signatures, no need to trust a middleman.

Let’s say a business hires a freelance designer through a platform that uses smart contracts. The moment the final files are submitted—and verified—the payment is released. Instantly. No invoicing. No waiting 30 days. No awkward follow-ups.

This is already in play in decentralized freelance platforms like Braintrust and Ethlance. More traditional platforms are exploring it, too.

Speed, Transparency, and Less Hassle

Here’s why businesses are paying attention:

- Speed: No waiting for bank hours. Crypto works 24/7.

- Transparency: Every transaction and contract is recorded publicly on the blockchain.

- No Middlemen: Say goodbye to unnecessary fees and third-party platforms.

The result? More trust. Less friction. And a system that just works.

Of course, we’re still early. But the direction is clear. As tech improves and regulations catch up, we’ll see more businesses switching from old-school wire transfers to blockchain-powered payments and contracts.

And that, once again, circles back to our main theme. How businesses use crypto isn’t just about holding digital assets or chasing hype. It’s about rethinking the very systems that move money and enforce trust.

Overcoming Barriers to Adoption

Image by Neel Shakilov from Pixabay

Crypto can be intimidating. For every exciting use case, there’s a headline about volatility, scams, or regulation. So even though the tech is here and the benefits are clear, many businesses still hesitate. Why? Let’s break it down.

Fear of the Fluctuation

First up: volatility. One day Bitcoin is booming. The next? It takes a nosedive. That kind of rollercoaster doesn’t sit well with accountants or CFOs. After all, no one wants to get paid in crypto, only to watch it drop 20% before lunch.

That’s a major reason stablecoins like USDC or USDT are rising stars. They stay pegged to the dollar, offering predictability without giving up crypto’s speed and efficiency. Still, fear lingers.

And let’s not forget regulation. It’s murky. It varies by country. And it changes fast. Business owners worry about tax nightmares or doing something accidentally illegal. Can you blame them?

Bridging the Knowledge Gap

Here’s the truth: a lot of business leaders just don’t “get” crypto yet. It sounds complex. Wallets, keys, smart contracts. It’s a whole new language.

But the good news? That’s starting to change. Education is growing. Platforms now offer crypto crash courses tailored for businesses. Financial advisors are learning the ropes. Even governments are stepping in with clearer guidelines.

Still, there’s work to do. To truly scale, we need to demystify crypto. Break it down in plain English. Show the “why,” not just the “how.”

Enter the Helpers: Crypto Payment Processors

Luckily, businesses don’t have to go it alone.

Companies like BitPay, Coinbase Commerce, and Strike are stepping in to simplify everything. These third-party services handle the nitty-gritty—wallet setup, transaction security, tax reporting—you name it.

Even better? Many of them convert crypto to fiat instantly, removing volatility from the equation. That way, a merchant can accept Bitcoin without worrying about price swings. Pretty clever.

Custodial wallets are also making crypto more accessible. These services hold and manage crypto on behalf of businesses, keeping keys safe and interfaces user-friendly.

Building Trust in a Decentralized World

Perhaps the biggest challenge of all? Trust.

Decentralized systems sound great. But for businesses used to banks, brokers, and legal contracts, letting go of those safety nets is a big ask. This is where transparency becomes key. Blockchain records can’t be changed or hidden. Every transaction is traceable. And as more reputable companies adopt crypto, the comfort level will rise.

So, how businesses use crypto isn’t just about cool tech. It’s also about overcoming fear, educating decision-makers, and rebuilding trust. One block at a time.

In a Nutshell…

So, how businesses use crypto is no longer just an experiment — it’s becoming a practical, strategic shift. From payments and smart contracts to loyalty rewards and global payrolls, crypto is entering the mainstream. Slowly? Perhaps. But steadily and undeniably.

Of course, challenges remain. Regulation, education, and trust still need time to mature. Yet businesses aren’t waiting. They’re adapting, innovating, and rethinking how they handle money and value.

If the last decade was driven by hype, the next will be defined by real-world use — real tools, real change, and real impact. Whether you’re leading a startup, managing a global brand, or simply exploring financial trends, now is the time to get involved. Embrace the possibilities, learn the landscape, and consider the potential of Crypto Long-Term Investment as part of your strategic future.

Because ready or not, the future of business is being built through crypto… block by block.