If you think mining or simple trading are the only ways to earn from crypto, then you’re wrong. Crypto arbitrage trading is one of the profitable strategies gaining traction, and here’s what it’s all about.

Crypto arbitrage is like a digital treasure hunt. Not for digital gold though. Rather, a hunt for the price differences in crypto assets between exchanges. You see, one cryptocurrency can have different prices across platforms. That’s due to market inefficiencies, liquidity variations, and execution speeds.

Traders found an opportunity here to capitalize on these discrepancies. And that’s what we call crypto arbitrage. While this concept sounds simple, it requires the right tools, speed, and an understanding of potential risks. Plus, since profits are smaller, you need to be patient and consistent to generate a meaningful income. Sometimes you even have to rely on communities, crypto Telegram signals, or even bots to achieve desired results.

So, how does crypto arbitrage work? And why do these price differences exist? Let’s dive into the fundamentals and explore how traders turn inefficiencies into opportunities.

What Is Crypto Arbitrage?

Photo by Anna Tarazevich

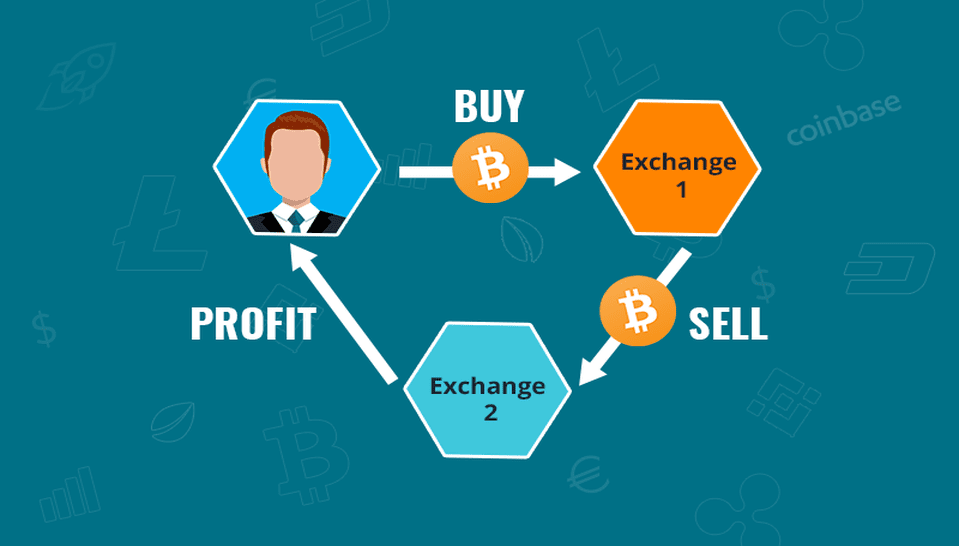

Crypto arbitrage is a trading strategy that takes advantage of price differences for the same asset on different platforms. For example, Bitcoin might be priced at $40,000 on one exchange but $40,500 on another. A trader can buy at the lower price and sell at the higher one. Thus, pocketing the difference.

Sounds simple, doesn’t it? But doing it in real-time is not that easy. And what makes it tough is the fast pace of crypto markets. Prices can shift within moments. Plus, fees can eat into profits and slow withdrawals can turn an opportunity into a loss. That’s why you need an excellent combination of speed, precision, and a solid understanding of market dynamics. And for those who can’t do that, bots and automation is the way to go.

With all that said, is crypto arbitrage a guaranteed way to make money? We wish that was the case. It’s a trading strategy. And like every other strategy, there are no guarantees. It is a game of timing, efficiency, and strategy. If you get all three of these spot on, you win.

Now, if you’re thinking that’s all about crypto arbitrage, you’re wrong. There are different types of it. That’s what we are discussing next.

What Are Different Types of Crypto Arbitrage Strategies?

Photo by RDNE Stock project

There’s no one single way of doing crypto arbitrage trading. Traders use different strategies. Each depending on market conditions, transaction speed, and risk tolerance. So, here’s a low down on different types of crypto arbitrage strategies.

1. Simple Arbitrage (Cross-Exchange Arbitrage)

This is the classic crypto arbitrage strategy. Buy a cryptocurrency at a lower price on one exchange. Then sell it at a higher price on another. Consider a scenario. Bitcoin is $40,000 on Exchange A and $40,500 on Exchange B. A trader can then buy on A and sell on B to make a $500 profit. However, the trader would still need to pay transaction fees on both ends. So, the final profit will be less than $500.

What to watch out for: Transfer times, withdrawal fees, and sudden price changes can eat into profits. Speed is key!

2. Triangular Arbitrage

This crypto arbitrage strategy doesn’t require moving funds between exchanges. Instead, it involves exploiting price differences between three different trading pairs within the same exchange.

For example:

- A trader starts with Bitcoin (BTC).

- They exchange BTC for Ethereum (ETH).

- Then, they trade ETH for Ripple (XRP).

- Finally, they convert XRP back to BTC

Ultimately, ending up with more BTC than they started with.

Why it works: Some exchanges have imbalances in trading pairs. This creates the opportunity for profit.

3. Spatial Arbitrage (Geographical Arbitrage)

Crypto prices can vary across different countries. That can be due to demand, regulations, and trading restrictions. Traders in one country might buy crypto at a lower price. Then sell it in another where demand is higher.

Challenges involved: Local laws, withdrawal limits, and the difficulty of moving funds across borders can complicate this crypto arbitrage strategy.

4. Statistical Arbitrage

This is where math meets crypto arbitrage trading. Statistical arbitrage uses algorithms, historical data, and predictive models to identify price inefficiencies. Bots execute hundreds of trades in seconds. The aim is for small but consistent profits.

Who goes for it: Mostly advanced traders and institutions with access to high-frequency trading tools.

5. Decentralized Arbitrage (DEX Arbitrage)

Decentralized exchanges (DEXs) operate differently from centralized ones. Thus, their pricing can sometimes lag behind the broader market. Traders take advantage of these delays. In this crypto arbitrage strategy, traders buy low on one DEX and sell high on another.

What’s the catch: Gas fees (especially on Ethereum) can be high, cutting into profits.

So, Which Crypto Arbitrage Strategy Is the Best?

The right crypto arbitrage strategy depends on your trading experience and circumstances. And not just that. Factors like risk appetite, access to trading tools, and crypto regulations also matter.

Overall, simple arbitrage is great for beginners. Statistical and algorithmic arbitrage suit tech-savvy traders. And spatial might be more suitable for digital globetrotters who can move assets between countries with relaxed crypto regulations.

Why Are There Price Differences in Crypto?

Photo by Tima Miroshnichenko

If crypto is digital and borderless, shouldn’t prices be the same everywhere?

Ideally, yes. But, things are far more complex. The crypto market is decentralized. You already know that. That also means each exchange operates independently. This lack of central structure leads to price variations.

Still, that’s just a nutshell explanation of the matter. Let’s break down the reasons for further clarity.

1. Market Fragmentation – No Single Price for Crypto

Cryptocurrencies trade on hundreds of different platforms. And each has its own pricing mechanism. Plus, these exchanges don’t share a universal order book. That’s why supply and demand on one platform may not match another. This creates price discrepancies.

Example: Bitcoin might be trading at $40,000 on Binance but $40,300 on Kraken simply because more people are buying it on Kraken at that moment.

2. Liquidity Differences – More Volume, Tighter Spreads

Liquidity means how easily you can buy or sell an asset. And that’s without significantly impacting its price. Major exchanges with high trading volumes usually have more stable prices. Think of Binance and Coinbase. On the flip side, smaller exchanges with lower liquidity experience more fluctuations.

Why does this matter: On less liquid exchanges, even a single large trade can shift the price. Thus, creating temporary crypto arbitrage opportunities.

3. Latency & Execution Speed – The Race Against Time

Crypto markets move fast. Sometimes within seconds. And so, delays in order execution, network congestion, or slow exchange updates can result in temporary price gaps.

Example: A sudden Bitcoin price surge on one exchange might take a few seconds to reflect on another. This gives arbitrage traders a brief window to act.

4. Regulatory & Geographic Factors – Same Crypto, Different Rules

Crypto isn’t regulated the same way everywhere. Some countries impose strict trading restrictions. Others are more lax. Similarly, some have higher taxes or capital controls. Others don’t. Thus, creating global discrepancies in prices.

Example: In countries with limited exchange access, like South Korea, Bitcoin has often traded at a premium because demand exceeds supply. That premium is often called “Kimchi Premium”.

5. Exchange-Specific Factors – Fees, Delays & Withdrawal Limits

Every exchange has its own rules on transaction fees, withdrawal speeds, and trading pairs. Higher fees or slower withdrawal times can affect arbitrage opportunities.

Key takeaway: Traders must account for these costs before jumping into an arbitrage trade. You won’t even notice how quickly fees eat into profits until you realize you’re left with pocket change.

In a nutshell, crypto price discrepancies aren’t random. They happen because of market structure, liquidity, execution speeds, and regulations. Smart crypto arbitrage traders keep an eye on these factors. And once the opportunity presents itself, they pounce swiftly.

How to Execute a Crypto Arbitrage Trade Successfully?

Photo by Tima Miroshnichenko

By now, we’ve discussed what crypto arbitrage trading is all about. The theoretical fundamentals of it. So, it’s time to move on to the practical side of things. And, what could be a better way to start than exploring how to execute a successful crypto arbitrage trade?

Let’s break down the key steps.

1. Find the Right Crypto Arbitrage Opportunity

First, you need to spot a price difference between exchanges. And you might be thinking of manually checking multiple platforms. That is nearly impossible. By the time you compare, the gap may be gone.

Thus, use automated tools and trackers. Websites like CoinGecko and CoinMarketCap show real-time prices across exchanges. Similarly, popular crypto arbitrage bots like CoinArbitrage and Cryptohopper help detect opportunities instantly.

Some traders also use custom-built bots to monitor price differences 24/7. But that’s only for those who are familiar with the ins and outs of the game. Plus, they have enough resources to spend on development of custom solutions.

Pro Tip: Focus on high-volume cryptocurrencies like Bitcoin and Ethereum, as they often have tighter spreads and lower risk.

2. Compare Fees and Execution Speed

Not all price gaps are profitable. Before jumping in, calculate:

- Trading fees – Every exchange charges fees for buying and selling.

- Withdrawal fees – Moving crypto between exchanges often comes with a cost.

- Deposit and withdrawal times – If a transfer takes too long, the price gap may disappear before you can act.

Pro Tip: Some traders keep funds on multiple exchanges to avoid withdrawal delays. This way, they can buy and sell instantly without transferring assets.

3. Execute the Trade Efficiently

Once you’ve found an arbitrage opportunity and checked the costs, it’s time to act:

- Buy low on Exchange A.

- Transfer the asset (if needed).

- Sell high on Exchange B.

- Pocket the difference (after fees).

Pro Tip: Speed is everything! Many arbitrage traders use trading bots to execute orders automatically. This ensures they don’t miss fleeting opportunities.

4. Manage Risks & Avoid Pitfalls

Crypto arbitrage isn’t always smooth sailing. Here’s how to manage risks:

- Beware of slippage: If an asset’s price changes before your order executes, you may lose part (or all) of your profit.

- Check exchange reliability: Not all platforms are trustworthy. Some have withdrawal restrictions or unexpected downtime.

- Be mindful of regulations: Some countries impose strict rules on crypto trading, which could impact arbitrage opportunities.

Pro Tip: Always test with small amounts first to ensure everything runs smoothly before scaling up.

Crypto arbitrage can be a lucrative strategy. But it requires planning, fast execution, and smart risk management. The key is to stay prepared. Use the right tools, factor in all costs, and execute trades as quickly as possible.

Best Crypto Arbitrage Bots

Image by freepik

You would’ve noticed by now how we keep repeating the pace of crypto arbitrage trading. So, to keep up with that pace, traders need to rely on bots. Otherwise, it is humanly impossible to keep an eye out for price fluctuations across so many exchanges and cryptocurrencies.

So, what are the best crypto arbitrage bots that you can employ? Here’s a comprehensive list:

1. Pionex Arbitrage Bot – Built-In and Beginner-Friendly

Pionex is one of the few exchanges that offers a built-in arbitrage bot, making it ideal for beginners. It automates arbitrage between spot and futures markets, ensuring profits with minimal risk.

Perks:

- Low fees (built into the Pionex platform)

- Runs 24/7 without manual intervention

- Great for traders who don’t want to code or configure bots

2. HaasOnline – Advanced and Customizable

HaasOnline is perfect for experienced traders who want full control over their arbitrage strategy. It supports custom scripts, allowing users to tailor their bot’s behavior.

Perks:

- Supports multiple arbitrage strategies

- Compatible with 20+ exchanges

- Custom scripting for advanced trading logic

3. Cryptohopper – Cloud-Based and Feature-Packed

Cryptohopper is a powerful, cloud-based arbitrage bot that requires no downloads. It integrates with multiple exchanges and allows users to run trades 24/7 from any device.

Perks:

- User-friendly interface with automated settings

- Works with over 75 cryptocurrencies

- No need to keep your computer running

4. Bitsgap – AI-Powered Arbitrage

Bitsgap combines AI-driven trading with advanced arbitrage strategies, helping traders make smart decisions faster. It provides a demo mode, so you can test strategies before committing real funds.

Perks:

- Smart AI to detect the best arbitrage trades

- Instant order execution for high-speed trading

- Works across 25+ major exchanges

5. Gunbot – Highly Customizable with a One-Time Fee

Gunbot is popular among serious traders because it allows full customization and no recurring subscription fees—just a one-time purchase.

Perks:

- Works with major exchanges like Binance and Kraken

- Supports multiple trading strategies beyond arbitrage

- Lifetime license available with no monthly costs

How to Choose the Right Crypto Arbitrage Bot

When picking a crypto arbitrage bot, consider:

- Automation Level: Do you want a simple plug-and-play bot or a fully customizable solution?

- Supported Exchanges: Make sure it works with your preferred trading platforms.

- Fees & Costs: Some bots charge monthly fees, while others have a one-time purchase option.

- Security Features: Always choose bots with strong security and API permissions to protect your funds.

A good bot can make crypto arbitrage faster, easier, and more profitable. However, no bot is foolproof. So, while they do the heavy lifting for you, keep a general supervision over the operations.

Challenges in Crypto Arbitrage Trading

Photo by Tima Miroshnichenko

You might think that crypto arbitrage is a pretty straightforward way to make money. Just buy low, sell high, and pocket the difference. But, it’s not always that simple. Price gaps do exist. And so do risks that can turn a profitable trade into costly mistakes. Understanding these challenges, thus, is crucial for long-term success.

1. Transfer Delays

Timing is everything in crypto arbitrage. Crypto prices can change within seconds. And so, any delay in transferring funds between exchanges can erase your potential profit.

Why it happens:

- Some blockchains, like Bitcoin, have longer transaction times.

- Network congestion can slow down withdrawals.

- Some exchanges manually process withdrawals, causing unexpected delays.

How to avoid it:

- Keep funds pre-loaded on multiple exchanges so you can execute trades instantly without waiting for transfers.

2. High Trading and Withdrawal Fees

Every transaction comes with a cost. These are the platform fees. And, they can quickly eat into profits.

Types of fees to watch out for:

- Trading fees – Charged when you buy or sell crypto.

- Withdrawal fees – Some exchanges charge high fees for moving funds.

- Deposit fees – Less common, but some platforms charge fees when adding funds.

What to do:

- Look for exchanges with lower fees

- Capitalize on platforms that offer zero-fee promotions.

3. Slippage

The price you see isn’t always the price you get. Slippage occurs when the price changes between the time you place your order and when it executes. If the price moves against you, you could lose money instead of making a profit.

Why it happens:

- Low liquidity means large orders can move the market.

- Price fluctuations happen faster than the order executes.

How to avoid it:

- Use limit orders instead of market orders to lock in a specific price when trading.

4. Exchange Liquidity

Not all exchanges have the same level of liquidity. If an exchange has low trading volume, there may not be enough buyers when you want to sell. This leaves you stuck with an asset that you can’t offload at your target price.

How to avoid it:

- Stick to well-established exchanges with high trading volumes and deep liquidity pools.

5. Regulatory and Legal Risks

Crypto regulations vary from country to country. Some governments impose restrictions on trading, withdrawals, or cross-border transactions, making arbitrage difficult.

Potential issues:

- Some countries tax arbitrage profits heavily.

- Exchanges can block accounts from certain regions.

- Regulations may change suddenly, affecting your trading strategy.

How to navigate:

- Stay updated on local laws

- Choose exchanges that comply with regulations in your region.

6. Security Risks

The crypto world has had its fair share of hacks, exit scams, and fraudulent exchanges. If you store large amounts of funds on a compromised platform, you could lose everything.

How to protect yourself:

- Use reputable exchanges with strong security measures.

- Enable two-factor authentication (2FA) on all accounts.

- Withdraw profits to a secure wallet instead of leaving funds on exchanges.

7. Competition

You’re not the only one doing crypto arbitrage trading. Arbitrage opportunities don’t last long. And there are thousands of traders and bots scanning the market 24/7 for that exact opportunity. By the time you spot a price gap, someone else might have capitalized it.

How to stay ahead:

- Use arbitrage bots for instant execution.

- Monitor market trends in real-time.

- Be prepared to act fast when opportunities arise.

So, crypto arbitrage can be profitable. Yet, with real risks. Transfer delays, fees, slippage, liquidity issues, and regulatory uncertainties can all impact your success. The best traders don’t just chase price differences. They plan, adapt, and manage risks carefully.

Tools and Platforms for Crypto Arbitrage Trading

Photo by Jakub Zerdzicki

Speed and accuracy make all the difference in crypto arbitrage trading. As we have highlighted earlier, finding price differences manually is nearly impossible. By the time you compare prices across exchanges, the gap may be gone. Or, some other arbitrage trader may have snatched the opportunity.

To match thispace, traders need specific crypto arbitrage tools and platforms. These resources help traders identify opportunities, execute trades faster, and maximize profits. Here’s a low down on the most useful ones.

1. Arbitrage Scanners – Your Eyes on the Market

Arbitrage scanners are essential for spotting price differences in real time. They can scan multiple platforms and alert you about potential opportunities. This saves a lot of time and drastically improves your success chances.

Top Arbitrage Scanners:

- CoinArbitrage – Tracks prices across hundreds of exchanges.

- CryptoCompare – Provides real-time price comparisons.

2. Automated Trading Bots – Execute Trades Instantly

You can also miss opportunities due to delays in trade execution. And bots can solve this problem by automating the process. They can execute buying and selling in milliseconds. This elimination of human delays and emotion-driven mistakes ensures you don’t miss profitable trades.

Popular Arbitrage Bots:

- Cryptohopper – AI-powered trading bot with arbitrage features.

- Bitsgap – Offers automated arbitrage trading across multiple exchanges.

- HaasOnline – Advanced bot for professional traders.

3. Exchange Aggregators – Compare Liquidity and Fees

Some platforms aggregate data from multiple exchanges. This helps traders evaluate liquidity, fees, and trade execution speed. Traders then can better assess the best exchanges for arbitrage, taking into account volume and trading activity.

Top Aggregators:

- CoinGecko – Tracks real-time prices and trading volume.

- CoinMarketCap – Provides exchange rankings and price analysis.

- Kaiko – Institutional-grade market data for deeper insights.

4. Cross-Exchange Trading Platforms

Instead of manually transferring crypto between exchanges, some platforms allow trading across multiple exchanges from one dashboard. This speeds up arbitrage execution drastically. And reduces transfer risks, too.

Best Multi-Exchange Platforms:

- Binance – Offers internal arbitrage across its spot, futures, and P2P markets.

- OKX – Allows cross-exchange trading with deep liquidity.

- 3Commas – Connects multiple exchanges for seamless trading.

5. Network Fee Trackers – Avoid Hidden Costs

Transaction fees can eat into arbitrage profits. Especially when transferring crypto between exchanges. Thus, using fee trackers helps traders stay aware of the best times to move funds. They help you avoid high network fees that could wipe out your arbitrage profits.

Useful Fee Tracking Tools:

- Etherscan Gas Tracker – Tracks Ethereum network fees.

- BTCFees – Shows Bitcoin transaction fees in real time.

- Blockchair – Analyzes fees across multiple blockchains.

6. Stablecoin & Fiat Arbitrage Trackers

Some traders might be more interested in fiat or stablecoin arbitrage. For them, these tools help track price differences between fiat pairs or stablecoins like USDT, USDC, and BUSD across exchanges.

Best Tools for Stablecoin & Fiat Arbitrage:

- ArbitrageScanner – Tracks fiat and crypto price gaps.

- Expatistan – Compares fiat currency exchange rates globally.

- Paxful – Monitors P2P price variations for fiat-based arbitrage.

As you can see, the right tools can make or break your arbitrage strategy. Employing a set of these tools, traders can stay ahead of the competition and execute trades efficiently. The key is to combine in what’s the most efficient way for you. That’ll give the best results. Just automate where possible, track fees closely, and always stay updated on price movements.

Now that we’ve covered the tools, let’s explore another thing that offers traders a powerful advantage. That is a crypto community. Crypto communities can help arbitrage traders spot opportunities and navigate challenges much more effectively.

How Crypto Communities Help Arbitrage Traders

Image by freepik

Crypto arbitrage trading can sometimes feel like a solo journey. That said, it is also true that no trader thrives in isolation. There may be some rare exceptions. But generally speaking, going solo is not recommended. Especially in crypto arbitrage.

So, where do you find fellow crypto arbitrage traders? You’ll find them at different crypto communities. Whether it’s through real-time market updates, strategy discussions, or exclusive arbitrage opportunities, being part of a strong network can significantly improve your success rate.

What do crypto communities offer though? Just a place to hangout? Well, they offer a lot more than that. Here’s a breakdown:

1. Real-Time Crypto Market Insights

Crypto communities provide instant updates on market movements, exchange liquidity, and even potential trading restrictions. That can be extremely helpful in making profitable crypto arbitrage trades.

Why It Matters:

- Some traders spot opportunities before scanners do and share them in groups.

- Members discuss liquidity issues or delayed withdrawals on certain exchanges.

- Communities can alert traders to risks, like sudden regulatory changes affecting cross-exchange trades.

Where to Find These?

Telegram groups, Discord servers, and Twitter communities dedicated to crypto arbitrage.

2. Shared Arbitrage Strategies and Expert Advice

Crypto arbitrage trading isn’t just about finding price differences. It’s about executing trades smartly. The best traders don’t just rely on data. Rather, they learn from experienced professionals who have mastered the game. Crypto communities allow members to share proven strategies, discuss challenges, and refine their approaches.

What You Can Learn:

- How to automate trades with arbitrage bots.

- Which exchanges have the lowest fees and fastest withdrawals.

- Tips on avoiding slippage and liquidity traps.

Any good examples?

Investors Collective, a growing network of crypto traders, actively shares insights on timing trades, minimizing risks, and leveraging high-volume exchanges for maximum profit.

3. Exclusive Arbitrage Opportunities

Not all arbitrage opportunities are obvious. Sometimes, price discrepancies arise from low-traffic exchanges, regional pricing variations, or institutional trading errors. In many cases, traders in crypto communities get early access to these gaps before they become widely known.

Examples of Insider Knowledge:

- Regional arbitrage: Some stablecoins trade at different prices in certain countries.

- P2P arbitrage: Some platforms, like Paxful or Binance P2P, have huge price differences for fiat-to-crypto conversions.

- Exchange promotions: Some exchanges offer zero-fee trading periods, increasing profit margins.

Where to Look?

Private arbitrage groups, investor forums, and exclusive trading circles.

4. Risk Warnings and Scam Alerts

Crypto arbitrage comes with risks. Fake exchanges, withdrawal limits, hidden fees, and market manipulation. Scammers often target crypto arbitrage traders by advertising fake trading platforms or exaggerated opportunities.

Crypto communities serve as a first line of defense, where traders:

- Warn others about suspicious exchanges or phishing scams.

- Share experiences with fraudulent platforms.

- Alert members about market manipulations before they get caught in a trap.

How to protect yourself?

Always verify information, even in trusted groups. Scammers sometimes infiltrate communities pretending to be genuine traders.

5. Networking and Collaboration

Arbitrage trading isn’t always a one-person game. In many cases, teamwork amplifies success. Whether by pooling funds for larger trades, accessing private exchange deals, or sharing account access across different regions.

Ways Traders Collaborate in Communities:

- Pooling funds to execute large-scale arbitrage trades.

- Account sharing to access region-locked arbitrage opportunities.

- Joint bot trading to automate high-frequency arbitrage across exchanges.

What are some examples?

Many successful traders in Investors Collective work together to execute high-volume arbitrage trades. Thus, taking advantage of larger price gaps that individual traders might not be able to exploit alone.

Ultimately, crypto arbitrage isn’t just about technology and numbers. It’s also about staying connected to the right people. Crypto communities provide shared strategies, exclusive opportunities, and essential risk warnings. This helps traders navigate the ever-changing landscape more effectively.

Ending Words on Crypto Arbitrage

Crypto arbitrage isn’t merely a trading strategy. It’s an opportunity to capitalize on market inefficiencies. Albeit a fast-paced one. But, with the right tools, a sharp eye for price differences, and a solid understanding of risks, traders can turn small gaps into steady profits. That said, don’t neglect strategizing, preparation, and information gathering.

Moreover, these opportunities don’t last forever. There’s often a window of barely a few seconds. That’s why leveraging trading bots, using real-time scanners, and engaging with crypto communities can give you the edge you need. The more you refine your approach, the better your chances of executing profitable trades.

So, whether you’re just getting started or looking to scale your efforts, crypto arbitrage remains one of the most exciting ways to navigate the world of digital assets. Just stay smart, stay connected, and trade wisely.